Amid speculation that capital gains tax (CGT) on share sales may increase in the Budget, GraniteShares has reported a notable rise in share sales by directors of UK-listed companies.

From 18-25 October 2024, directors sold £29.8m worth of their company shares, with buy transactions totalling only £4.1m.

Over the four weeks from 27 September to 25 October, share sales by directors reached £163.4m, compared to £48.5m in purchases.

CGT on share sales, currently capped at 20%, is expected to rise by several percentage points when the Budget is announced tomorrow (30 October), leading to increased sales activity among directors.

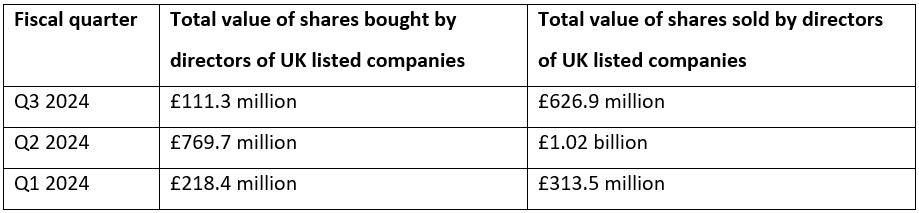

Combined value of shares bought and sold by directors of UK listed companies, by fiscal quarter:

Will Rhind, founder and CEO of GraniteShares, said: “Our analysis reveals that company directors of UK listed companies are racing to sell shares ahead of a widely anticipated capital gains tax raid in tomorrow’s Autumn Budget.

“Shares that are held outside of an ISA are subject to CGT on any profit made when you sell them. Everyone receives an annual CGT allowance of £3,000, but any gains above this can be subject to CGT.”

GraniteShares is an Exchange Traded Products (ETPs) provider managing over $9bn.

Comments