The Bank of England has announced interest rates will remain unchanged at 5.25% for the sixth time in a row.

The BoE’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target.

At its meeting ending on 8 May 2024, the MPC voted by a majority of 7–2 to maintain bank rate at 5.25%.

Two members preferred to reduce bank rate by 0.25 percentage points, to 5%.

The MPC has judged since last autumn that monetary policy needs to be “restrictive” for an extended period of time until the risk of inflation becoming embedded above the 2% target dissipates.

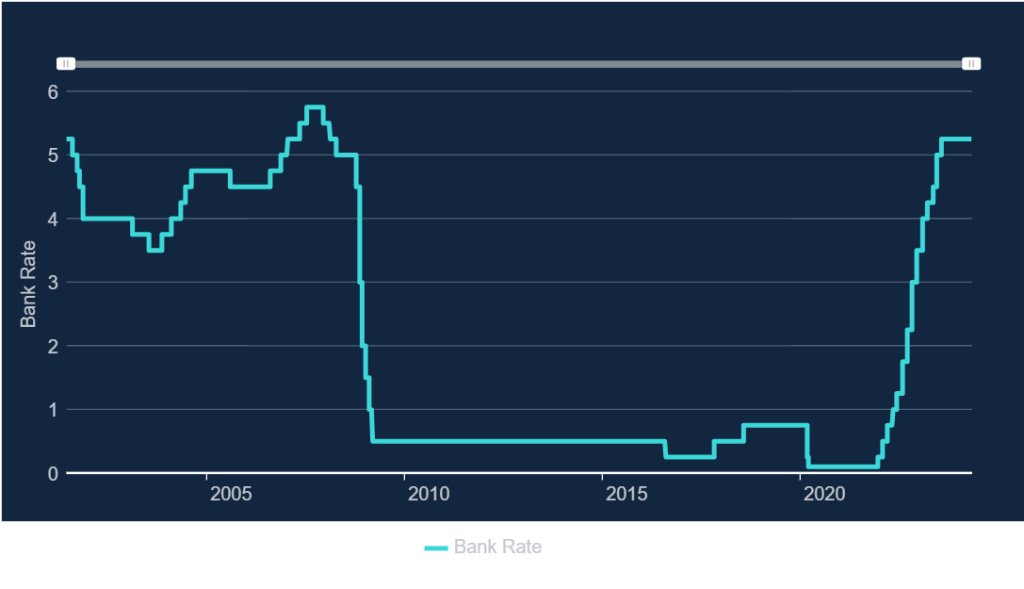

Official bank rate since 2001

Mazars chief economist George Lagarias said today’s decision was a “foregone conclusion”.

“Rate cuts at some point this summer are also baked in prices. The question for consumers is not whether the BoE will cut rates this year, which is highly probable, but rather whether it is ready to enter a rate-cut cycle.

“Multiple rate cuts might be difficult, with the US Federal Reserve maintaining cycle-peak rates for the foreseeable future, as this would risk capital flight and importing American inflation.

“The Bank probably knows that a lower rate is appropriate at this point. It is possibly buying time for wage inflation to come down a bit further and for the Fed to make its own intentions clearer.

“While rate cuts are probably on the way, businesses and consumers should not plan for multiple rate cuts right away.”

Interactive Investor senior personal finance analyst Myron Jobson said: “The Bank of England (BoE) has kept interest rates steady for the sixth time in a row and will continue its ‘wait and see’ approach until it feels that the conditions necessary to cut the base rate are met.

“Premature cuts to interest rates risk unpicking the BoE’s efforts to tame high inflation.

“While headline inflation has fallen to 3.2%, which is still above the 2% target, wage growth appears to be too high for comfort for BoE policymakers, with a tight labour market exacerbating matters. The worry is this would entrench higher inflation over time.

“So, for now, Britons are still being buffeted by a double whammy of high inflation and high interest rates. With interest rates likely to remain high for some time, debt repayments will be a priority for many.

“The stark reality is even if the BoE cuts interest rates in the summer, high interest rates aren’t going to disappear overnight. Interest rates could remain higher for the next decade than they were in the decade after the 2008 financial crisis.

“This shift has been particularly challenging for mortgage holders, who face higher costs when they remortgage stemming from higher mortgage rates.”

Comments