Good morning and welcome to your Morning Briefing for Wednesday 6 March 2024. To get this in your inbox every morning click here.

It’s Budget Day!

Today is the day we’ve all been waiting for: it’s Budget Day.

As is always the case, much of what chancellor Jeremy Hunt is expected to announce has been trailed in the nationals.

Hunt is expected to make changes to non-dom status, maybe even scrap it, and bring in a vaping tax to fund a potential 2p national insurance cut.

Perhaps there will be some surprises too.

Quilter ongoing advice

Quilter has said the Financial Conduct Authority’s ongoing advice review may result in the company incurring “remedial costs” – but said at this stage it is “too early to quantify” how much they would be.

The regulator has written to 20 firms, including Quilter, requesting information regarding ongoing servicing.

Rathbones/Investec merger bears fruit

Rathbones’ underlying profit before tax increased by 30% to £127.1m in 2023, up from £97.1m the previous year.

This included a £25.4m contribution from Investec Wealth and Investment in the final quarter.

The businesses merged in September last year.

LoA horror show

We live in advanced times, says Tom Browne in his editor’s view.

“Whether one likes it or not (and I’m not sure that I do), technology has crept into every nook and cranny of our lives, and improvements in artificial intelligence continue to accelerate this trend.

“So, why is it that a crucial part of the advice process is mired in another age? I speak, of course, about letters of authority (LoAs).”

Quote Of The Day

The chancellor now needs to encourage pension funds to deploy more of their capital in a way that boosts Britain’s economy and its markets – getting pension funds to allocate more capital to British companies is a great way to start.

– Darius McDermott, managing director of Chelsea Financial Services, calls on chancellor Jeremy Hunt to mandate pension funds to invest more of members’ savings in UK-listed companies

Stat Attack

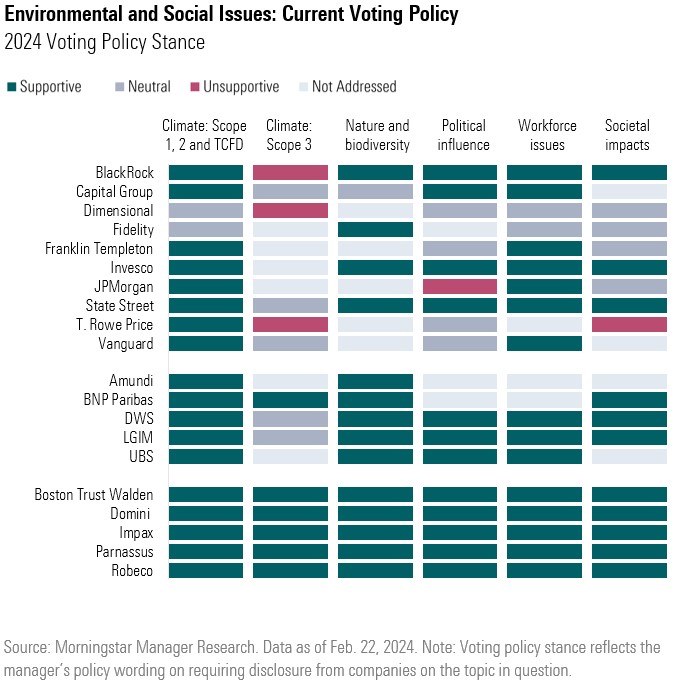

Morningstar has released its latest paper on proxy-voting insights, assessing the shareholder voting consensus across the 10 largest US asset managers. The report demonstrates that there is no consensus among these managers on disclosures about scope 3, and political and societal impacts.

Source: Morningstar

In Other News

An expert has warned cryptocurrency users to be “vigilant” around their funds as bitcoin soared to a record high, topping £54,000 yesterday (5 March).

The findings are based on a new analysis of scam data conducted by Smart Betting Guide, which found users lost more than £1.3bn due to exploits and exit scams last year – with bitcoin the second-most affected currency.

Over the last year, bitcoin users saw £209m stolen by scammers, equivalent to 15% of the total sum lost. The most common tactic scammers used was an access control exploit, used to take two-fifths of bitcoin’s total stolen funds (46%).

This exploit sees scammers exploit a vulnerability to gain access to user credentials or data through compromised private keys, networks or security systems.

With the cryptocurrency skyrocketing in value on Tuesday, exceeding £54,470 at one point, many users may be considering increasing their investment to capitalise on the rise, while first-time investors may also be tempted.

The spike came after the Securities and Exchange Commission allowed 11 firms to start exchange-traded funds (ETF) based on bitcoin, which can be traded like stocks.

From Elsewhere

How high taxes and low growth have squeezed Britain’s top earners (Financial Times)

Morgan Stanley cuts 9% of China fund unit staff amid market rout, sources say (Reuters)

Money blog: Revolut customers warned after £200,000 stolen from two accounts – and they didn’t get it back (Sky News)

Did You See?

In this episode of In Conversation With, Lois Vallely is joined by Cathi Harrison, CEO at The Verve Group, as they delve into the challenges and opportunities facing financial advisers. With International Women’s Day on the horizon, they also explore what’s needed to attract diverse talent and more women into the industry. Listen now:

Comments