Good morning and welcome to your Morning Briefing for Thursday 22 February 2024. To get this in your inbox every morning click here.

‘Outliving savings’ top concern for advised clients

Outliving their savings is the primary concern among advised clients when thinking about retirement, new research from NextWealth has shown.

Overall, 71% of the 200 financial advisers surveyed said their clients’ main worry is running out of money before they die.

Inflation/cost-of-living follows closely at 64%, while 49% of advisers cited covering long-term care costs as another client concern.

Phoenix Group to host financial services vulnerability summit

Phoenix Group has announced it will host a UK-wide financial services ‘vulnerability summit’ in a bid to help address a problem that is ‘growing in scale and urgency’.

The summit will bring together over 80 experts from the financial services sector including insurance, banking and leading UK charities.

There will also be representatives from key non-profit organisations, the Department of Work and Pensions and the Financial Conduct Authority.

Another triumph for the optimists

It is tempting to believe an investor’s long-term outcome depends on how many successful companies they can invest in, writes Humans Under Management founder Andy Hart.

While this metric will certainly have some bearing on their returns, he believes the key metric that determines success is how many temporary declines – or bear markets – they can endure with patience and discipline.

He adds that, often characterised by worsening economic fundamentals and widespread panic, these periods test the resolve of even the most experienced investors.

Quote Of The Day

Despite being paid by a small proportion of estates, IHT is unpopular and has attracted attention as one of the taxes the Chancellor could look to cut at the spring Budget, in a last roll of the fiscal dice before the election battle proper commences.

-Laura Hayward, Tax Partner at Evelyn Partners, comments on rumours that the government may either scrap IHT or cut the headline rate in the budget.

Stat Attack

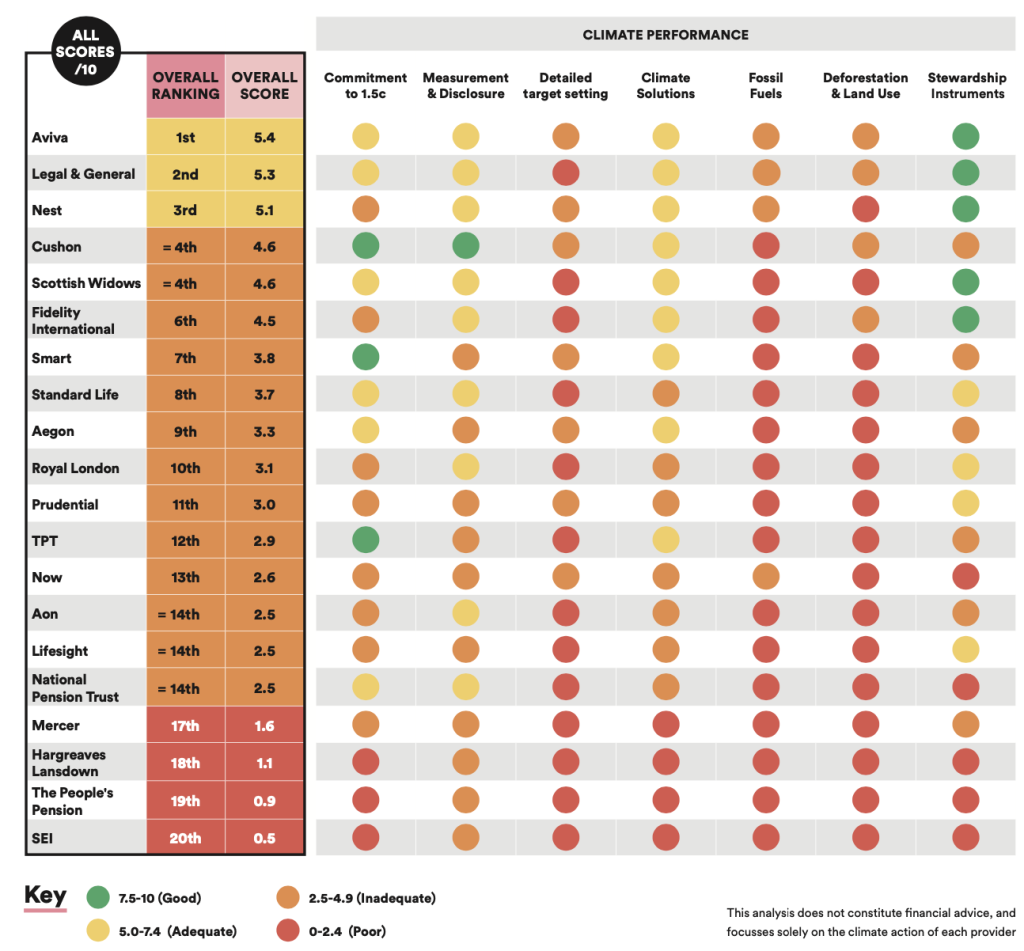

A new ranking from Richard Curtis’ Make My Money Matter campaign shows that 85% of leading UK pension providers have inadequate or poor climate plans in place. These providers collectively manage more than £500bn in assets and have more than 15 million active members.

Source: Richard Curtis

In Other News

Specialist independent investment manager Redwheel has announced its strategic partnership with Turquoise, the UK’s longest established specialist in ClimateTech venture investments.

The partnership’s project, subject to regulatory approval, will be a growth-stage UK ClimateTech venture fund.

It focused on easing the shortage of growth capital for UK companies with technology or services that address environmental challenges and promote sustainability in order to deliver measurable impact.

The Redwheel-Turquoise investment team will aim to identify promising post-revenue and growth stage companies with demonstrated potential to disrupt their industries in the near term.

The strategy will be centred around three key sectors: energy; transport and mobility; and resource efficiency.

Evelyn Partners has appointed Reinoud Noorduijn as a Certified Financial Planner in its Guildford office. The move is part of the wealth management group’s plan to continue growing the number of clients it works with in Surrey.

Noorduijn joins Evelyn Partners from Sheraton Financial Planning in Fareham where he spent more than two years and was an Associate Financial Planner. He works with clients to get to know their circumstances and what they want to achieve before agreeing a financial plan that will help meet their long-term goals.

He will be based at Evelyn Partners’ office at Onslow House, in the heart of the city, which offers clients a range of financial and professional services including financial planning, investment management and tax advice from highly qualified experts. The financial planning team in Guildford has expanded rapidly in recent years, growing from five advisers in 2021 to 14 today.

From Elsewhere

Nvidia declares AI ‘tipping point’ as quarterly revenues jump 265% (Financial Times)

Japan Nikkei hits record high last seen more than 30 years ago (Bloomberg)

Lloyds profit jumps despite UK outlook, motor finance provision (Reuters)

Did You See?

The FCA has said price and value is the most challenging outcome of the Consumer Duty for adviser firms to meet seven months after the regulation came into force.

FCA’s executive director for consumers and competition Sheldon Mills said firms should do more on fair value and pricing to ensure good outcomes for consumers.

He said: “Many of the fair value assessments we have seen are not relying on solid data and other credible evidence to justify the products’ value to retail customers.

“Some firms, for example, have relied solely on benchmarking against the market when considering their pricing, rather than considering a fuller range including the real value that a consumer derives compared to the price they pay. The equivalent of a Google Shopping search does not prove to us that a customer is getting a fair deal.”

Comments