I once tried to learn to play poker. My ex-boyfriend had been a semi-professional poker player in his younger years, so we spent a few evenings practising Texas Hold ’Em.

Had I kept it up, I think I would have become proficient. I have many of the skills required to be a good poker player. I am good at reading people. I have a staunch poker face — I have often been told I am hard to read, even by those who know me well. And I can definitely stay calm under pressure.

Alas, I did not get a handle on the rules, so winning the World Series of Poker was never on the cards.

I think there’s a lot of muddled thinking going on here

Also essential to being a good poker player is knowing when to hold and when to fold. This is something prime minister Rishi Sunak and leader of the opposition Keir Starmer are grappling with at the moment — in relation not to poker but to the state pension triple lock, about which both of them are being incredibly tight-lipped.

It has sent the internet, especially the platform formerly known as Twitter, into a spin.

Last month, the Office for National Statistics published its latest earnings figures. These showed annual growth in employees’ average total pay, including bonuses, of 8.5% in May–July 2023.

Thanks to the state pension triple lock, this data means — as AJ Bell head of retirement policy Tom Selby put it — retirees are set to receive their second “blockbuster” state pension increase in a row. Pensioners enjoyed a 10.1% increase in their pensions this year.

There is no pot of money with your name on it. This is still a common misconception

The triple lock was introduced in 2010 by the Conservative-Liberal Democrat coalition government in recognition that the real value of the basic state pension had fallen over many years. It is a policy commitment whereby the government raises the state pension annually in line with the increase in prices or average earnings, or by 2.5% — whichever is highest.

Editor’s view: Who’s got the key to the triple-lock challenge?

Pensions poker

In reaction to the wage rise news, Aegon pensions director Steven Cameron put out a statement saying the state pension triple lock’s future was “turning into a game of pensions poker”. Yes, I stole his analogy for our cover feature imagery.

“Both the Conservatives and Labour are keeping their cards close to their chest, with political risks for whoever shows their hand first,” said Cameron. “The big question is whether to stick or twist.

A more honest way of looking at this would be that we can’t keep the triple lock forever

“Sticking with the current formula would create huge and unpredictable costs met from the National Insurance Contributions [NICs] of today’s workers at a time when both parties need to make sure they can visibly balance the books.

“But being first to twist by announcing an end to the triple lock risks losing the support of swathes of older voters.”

There has been a lot of media hysteria about the fact neither Starmer nor Sunak will commit to retaining the triple lock. But who can blame them?

A large proportion of the general public does not understand the state pension in general, let alone the triple lock and what it actually does.

And, to make matters worse, with the advent of Covid and amid high inflation the whole topic has become very sensitive.

Energy would be much better spent learning about how the state pension system works

Many British adults regard the state pension as a benefit they have worked for and therefore deserve. I can understand this misconception because it is one I held before I joined the ranks of Money Marketing and became more informed.

Working people must pay NICs — these are even called ‘contributions’ — and, at a set age, they start to receive their state pension. The government does not do a good enough job of educating people about the fact that, actually, their NICs are paying for the state pensions of today’s senior citizens, among other things.

Fact, not opinion

Pensions expert Nic Millar, who has worked in the space for more than 30 years, has been all over the issue on social platform X.

Addressing some common misconceptions about the triple lock and the state pension, she quotes: “‘State pension is measly.’ ‘I paid enough NI to cover my state pension.’ ‘I want my contributions back; I’d have got more if I’d invested them.’ No. No. And no.”

Increasing the state pension for over 12 million pensioners doesn’t target those who need the most support

“The energy spent on trying to distance pensioners from benefit claimants would be much better spent learning about how the state pension system works,” she adds. “It’s a benefit payment. It’s not a matter of opinion — it’s a fact.”

The Lang Cat communications director Mark Locke wrote, as part of a thread on X: “State pensions are paid out of general taxation. It’s always been that way. There is no pot of money with your name attached.

“This is still quite a common misconception — ‘I’ve paid in all my life. I’m entitled to….’”

One particularly stark response to Locke’s thread, which demonstrates perfectly my point above, reads as follows: “Poppycock. If it’s just a benefit then we should be given the choice to opt out, mate. If I’d invested my thousands of £££ contributions over 45 years into a private pot, I would now be receiving 4x the pension, instead of paying for your NHS and education.”

This is a commonly held view. Independent financial planner Matthew Tumbridge said, also in response to Locke: “But people don’t feel that way because, when they do a state pension forecast (or ask the boss why NI is deducted), they are told, ‘If you pay X (missed) contributions, you will receive Y (more) state pension.’”

I would like to see a commitment to review the triple lock and explain the criteria that would be used to come up with an alternative

This misconception about the state pension creates problems for the government of the day.

David Penney, co-founder and director of financial planning firm Penney, Ruddy and Winter, says: “In this country, there’s this cultural field of argument that says, ‘I’ve paid my dues.’ So people think they’re paying into a pot and then just getting their money back.

“Therefore, anything you do to make it worse, whether it’s putting the age back or reducing the rate of increase, they see it as taking something away from them.

“The Conservatives have got a problem in doing anything about it because there is that widespread belief or misinformation. Everyone believes they’re paying into a pot and you’re taking something away from them that they’ve accrued, rather than it is a benefit.”

It might well become unaffordable if you keep it going for a quarter of a century, but that isn’t a reason to switch it off tomorrow

Chartered financial planner David Hearne agrees.

“When you see people comment on Twitter [now X] about taking it away or changing it, lots of people seem to assume that means you don’t want pensioners to have pension increases or you want them to starve or something,” he says.

“I know we see extremes on social media, but I don’t think people understand that scrapping something doesn’t mean the alternative is really bad.”

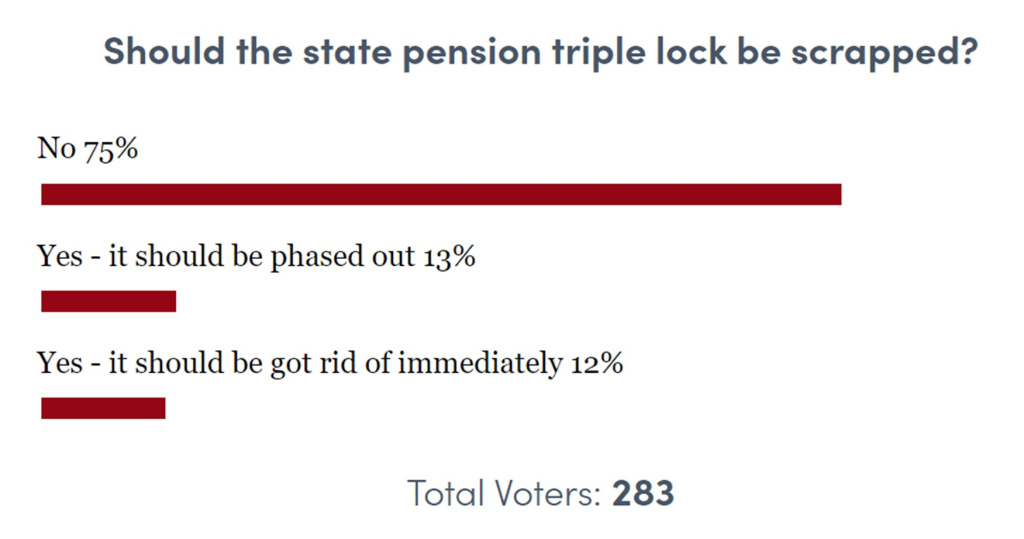

So should the triple lock be scrapped? A Money Marketing poll suggests our readers think not.

And a poll by money expert Martin Lewis suggests a large proportion of the general public feels the same.

Today’s Twitter Poll: Is it time to end the state pension triple lock? That’s a growing political debate. What do you think.

Triple Lock: The state pension rises each year by the highest of inflation, average earnings rise or 2.5%. Likely to mean next rise is 8.5%.

— Martin Lewis (@MartinSLewis) September 13, 2023

But I spoke to some advisers and pensions experts for this feature who believe the triple lock has outstayed its welcome.

Unpredictability

One issue, Hearne suggests, is the triple lock is very difficult to forecast.

The Institute for Fiscal Studies (IFS) put out a report last month that went some way towards illustrating this. It says the triple lock creates “significant uncertainty” regarding the amount of state pension people might receive in the future.

You just can’t take state pensions out of politics

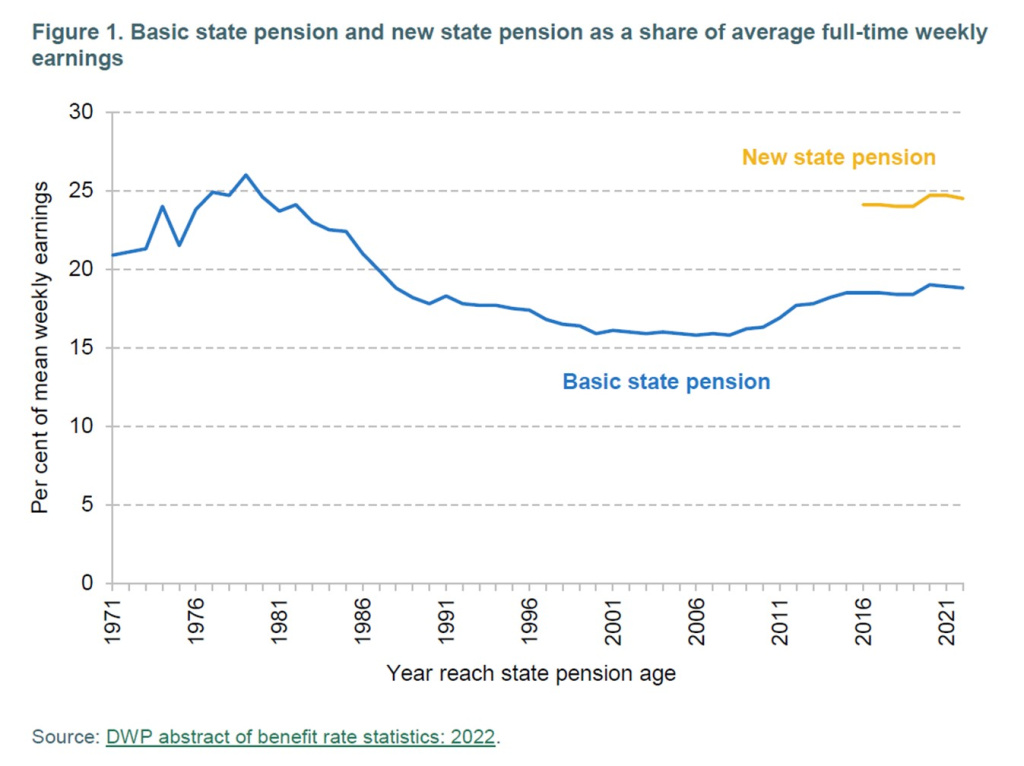

A full new state pension is currently equivalent to 25% of full-time mean earnings.

“If the triple lock is kept in place indefinitely, a reasonable range (occurring 80% of the time) for the value of the state pension in 2050 is between 26% and 32% of mean full-time earnings,” the report says.

“This would mean a range of £10,900 to £13,400 per year — a difference of £2,500 per year in today’s terms.

“Based on our calculations, a reasonable estimate (taking place 80% of the time) for additional spending on the state pension in 2050 due to the triple lock, above and beyond earnings indexation, would be between £5bn and £45bn a year in today’s terms (taking into account the growing size of the pensioner population).

“This range is so large because of the uncertainty over the path of the state pension that the triple lock creates. This unpredictability makes it much more difficult for the government to plan future finances.”

Well intentioned

The triple lock has been in place for more than 10 years, notwithstanding a year when earnings figures were so warped by the Covid pandemic that the government decided to forgo it.

You might say, ‘Well, what’s wrong with it being linked to inflation?’

“When the triple lock was introduced, it was well intentioned and probably quite a needed approach because state pensioners had been lagging behind,” says Cameron.

“They hadn’t been keeping pace with growth in the economy, for example, so it was a well-intentioned policy intervention.

“It was introduced at a time when we had low and stable inflation, low and stable earnings growth. So the idea of having the highest of 2.5%, earnings or inflation didn’t seem too controversial, and it worked for quite a few years.

“But the unfortunate thing is now we’re in a very different time, which is so volatile. So we’ve got highly volatile and unpredictable inflation, at very high levels.

“Equally, earnings growth has been all over the place in the past few years.

I don’t think people understand that scrapping something doesn’t mean the alternative is really bad

“Had we had such volatile movements and those indices back when it was introduced, it would never have been introduced. No one would have come up with this, so it’s no longer fit for purpose in today’s world of volatile economic conditions.”

Lane Clark and Peacock partner Steve Webb was the brains behind the triple lock. He served as pensions minister under the coalition government from 2010 to 2015.

Webb believes a lot of the current discussion around the triple lock is “ill informed and a bit panicky”.

He says: “The obvious example would be this 8.5% [earnings] figure. People are saying, ‘That’s a big increase. We can’t afford it.’

“Well, the first thing I would say is, if wages have gone up 8.5%, so have taxes. In fact, they’ve gone up by more than that because of the way the tax system works. Clearly, in a period when they’re freezing tax allowances, when wages go up fast the Treasury gets a lot of tax.

“It seems really weird to me to say, ‘We can’t afford 8.5% because that’s what wages have gone up by,’ without allowing for the fact that revenues have gone up by more than they thought.”

The idea behind the triple lock was to bring up the value of the state pension. It had been on a downward spiral after former prime minister Margaret Thatcher broke its link with earnings in 1980.

The triple lock creates uncertainty over the path of the state pension

“You might say, ‘Well, what’s wrong with it being linked to inflation?’” says Webb.

“The point is pensions are about replacing earnings. And, if pensions are drifting down year after year because they’re being linked to prices rather than earnings, you get a big edge down in your income because the pension has lost pace with earnings.

“At the very least you’d want pensions to keep pace with earnings for that reason.”

Because, by 2010, the state pension had suffered 30 years of decline, the government believed it needed to “do better” than just keep pace with earnings.

“We needed to restore some of that lost value,” says Webb. “And that is where the triple lock comes in.”

Guaranteed rise

By linking the state pension to the highest of either earnings, inflation or 2.5%, there is a guarantee it will always rise.

This was introduced at a time when we had low and stable inflation, low and stable earnings growth

Of the triple lock, Webb says: “There comes a point where you switch it off, and the point where you switch it off is, let’s say, a third of the average wage.”

The Turner Commission — a pensions body that operated in the mid-2000s, initiated by the government — had suggested the state pension should be worth a third of the average wage. A private pension makes up another third, and that gives a pensioner two-thirds of their final salary, which is deemed roughly what they need to live on.

“We’re not a million miles away from that,” says Webb. “So I say, keep the triple lock running for, say, five to 10 years, and then you have an earnings link.”

He adds: “I’ve read the IFS report, which says, in 2050, the triple lock will be unaffordable. Well, that’s over a quarter of a century away.

“It might well become unaffordable if you keep it going for a quarter of a century, but that isn’t a reason to switch it off tomorrow.

In this country, there’s this cultural field of argument that says, ‘I’ve paid my dues’

“I think there’s a lot of muddled thinking going on here.”

Political battleground

It is unlikely this government will get rid of the triple lock. After all, the next general election is scheduled to be held no later than January 2025, but could be called earlier than that.

Cameron says he does not believe any party should commit to keeping the triple lock right now as that “would not represent financial or fiscal discipline”.

He also hopes it does not become a political battleground.

“In an ideal world, it would be the sort of thing that would be done outside politics, but you just can’t take state pensions out of politics,” he says.

“I would like to see a commitment to review the triple lock and explain the criteria that would be used to come up with an alternative.”

It’s a benefit payment. It’s not a matter of opinion — it’s a fact

AJ Bell’s Selby thinks the triple lock cannot be maintained in the long term.

“The cost of that to the state would be unsustainable, and the burden on younger generations would also be unsustainable,”

he says. “At some point either this government or, more likely, a future government will need to be more honest about what they believe the state pension should be worth.”

Selby says the triple lock is essentially the government “admitting the state pension is too small”, but “it’s only committing to increase the value of the state pension in real terms when earnings and inflation are below 2.5%”.

He adds: “My view is, rather than debate whether we should keep the triple lock, we should have some cross-party consensus on this.”

Selby suggests the government should commission an independent review to decide the exact figure to which the state pension should be aligned.

Sticking with the current formula would create huge and unpredictable costs

“It will probably be a figure in relation to average earnings or something like that.”

Realistically, given the nature of the triple lock debate has been cemented for over a decade, Selby says he will be “staggered” if either of the main political parties goes into the general election saying, ‘We should scrap it.’

“That’s part of the problem,” he argues. “Because a more honest way of looking at this would be that we can’t keep the triple lock forever. So let’s consider what should be in its place, what the state pension should be worth and how we can get to that point now.”

Pension Credit

Millar suggests the solution is to increase Pension Credit, which opens up access to other benefits and to support with rent, heating, council tax and so on.

“Increasing the state pension for over 12 million pensioners doesn’t target those who need the most support,” she says.

Being first to announce an end to the triple lock risks losing the support of swathes of older voters

“An 18% increase in state pension for 12 million pensioners in just two years? Madness.”

In the short term, it looks as though the state pension triple lock is here to stay. But will a future government decide to hold or fold? If the latter, what will it replace it with — if anything? And will I ever become a professional poker player?

These are all questions that, for now, remain unanswered.

Auto-enrolment gets extended

Pensioners should not rely on the state pension alone. The government brought in automatic enrolment in 2012 as a way to get more people saving into a private pension.

Since it came in, auto-enrolment has transformed UK pension saving, with nearly 11 million people enrolled so far.

In September, the Department for Work and Pensions (DWP) confirmed the age restriction on auto-enrolment would be lowered from 22 to 18. Reforms also included the removal of the lower-earnings limit for minimum contributions.

Under the new rules, the first £1 of earnings will qualify for matched employer contributions and tax relief.

The changes have been a while in the making but the Pensions (Extension

of Automatic Enrolment) (No. 2) Bill will become law after receiving Royal Assent.

The private members’ bill passed its third reading in the House of Lords and means millions of people will be able to start saving into a pension sooner.

The bill was introduced in the House of Commons by Jonathan Gullis and taken through the House of Lords by former pensions minister Ros Altmann.

The DWP said the changes to auto-enrolment, combined with the Mansion House Reforms announced by the chancellor in July, could see the average earner’s pension increase by nearly 50% if saving across their entire career.

Meanwhile, a minimum-wage earner could see their pension pot increase by more than 85%.

This article featured in the October 2023 edition of MM.

If you would like to subscribe to the monthly magazine, please click here.

This is somewhat of a superfluous debate. What is not taken into account is that UK State Pension is the most parsimonious in the G20. The current total cost of the UK state pension is 4.5% of GDP. To compare; France spends 14% of GDP and is not the biggest spender. The average in the OECD is around 8% – so it rather illustrates that our pension is nothing to shout about. Just a few examples: The max State Pension in Spain is equivalent to £2,287/month. In France £1,485, in Belgium £2,709, Germany £1,868. Compare this to what we get – around £883/m and we have a later retirement age than most.

This is all probably more of a philosophical argument than an financial or economic one.

The question is should there be a state pension at all?

Discuss.