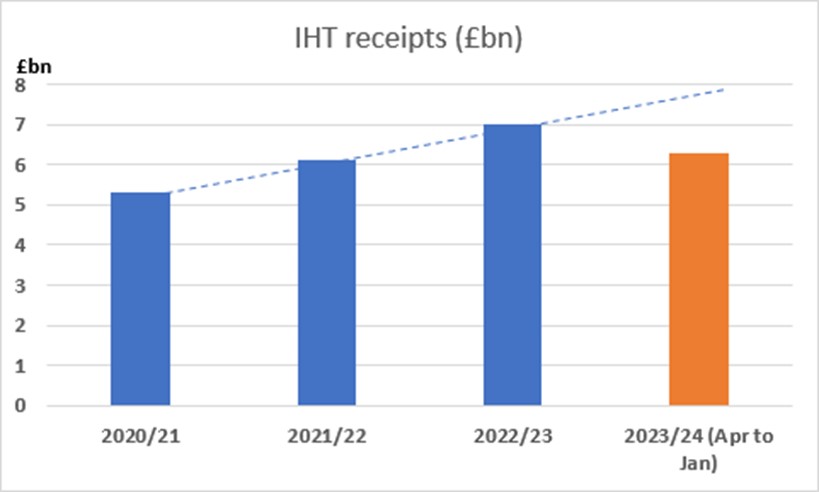

IHT receipts for April 2023 to January 2024 are £6.3bn, which is £400m higher than the same period last year, according to HMRC figures published today (21 February).

Nucleus technical services director Andrew Tully suggested last year’s record-breaking IHT receipts of £7bn look set to be broken again, continuing the “strong upward trajectory” over the past few years.

He said that, with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28, receipts are set to continue growing strongly, despite slower house-price growth.

They may well exceed those OBR predictions, given this year’s receipts are on track for around £8bn, he added.

“There are rumours the government may consider changes to, or even the abolition of, IHT. However, with the possibility of other taxes applying to assets passed on after death, and Labour saying it would reverse any abolition, the need to engage early with planning and advice is crucial,” Tully continued.

“Advisers can help manage an estate by setting up trusts, making use of gift allowances and using a pension to pass on wealth to family in a tax-efficient way.”

Canada Life tax and estate planning specialist Stacey Love said: “Inheritance Tax has contributed £146mn per week to the treasury, and so far, this financial year, receipts are up by around 6% compared to the same period last year.

“If receipts continue on the current trajectory, we’ll be on track to beat last year’s record. Indeed, the OBR has forecast that HMRC will collect £7.2bn in 2023/24.

“Of course, all eyes and ears will be on the Spring Budget in a few weeks’ time, to see what, if any, changes are proposed to Inheritance Tax.

“Regardless of sentiment towards Inheritance Tax, our research shows that a quarter of over 55s (25%) do not know if their estate will be taxed. In short, a complex system plus housing market buoyancy and frozen thresholds could mean more households receiving an unexpected bill from the taxman.

“There are legal means to mitigate paying inheritance tax though, such as the use of trusts and gifting. Rules around gifting and trusts are nuanced, however, so seeking professional financial advice to help you navigate the system is a good idea.”

I cannot see ANY Govt. blanking IHT…

Bear in mind a big windfall will come under Labour with current non doms, to be taxed on WWI, many will move at least some assets to UK.

Labour look set to make CGT more applicable upon disposable/transfer events too…

Certainly, there may be a (more) graduated scale of tax rate – 0 to 40% in one go is crazy – but oversll, it looks here to stay…

Note that the wide use of trusts is an easy area of fiscal attack; and not a great vote loser for Sir K, and would assuage his ever present Mementoron fanatics too!

Still, Captain Hindsight (Scarlet politically) does have his Skybase Angels to protect him… Melody, Harmony, and Destiny… or are they Angela, Rachael, and … take your pick… quite which ones are the puppets is anybody’s guess… 😀

The trouble is… CH’s Cloudbase seems uncontrollable… keeps veering 180 degrees!!