Interest in issues of climate change and sustainability continues to rise and, with it, the threat of greenwashing becomes ever more prevalent.

In October last year, the Financial Conduct Authority proposed a package of measures to clamp down on greenwashing. These included investment product sustainability labels, and restrictions on how terms such as ‘ESG’, ‘green’ or ‘sustainable’ could be used.

Before the FCA’s labels come in, though, advisers are having to navigate the ESG world themselves. And one way for them to do this is by using ESG ratings.

If ratings are being used to mask subjective information, the adviser needs to look through that

But how reliable are ratings from third parties? Should advisers use them?

The answer is not as simple as ‘Yes’ or ‘No’. It depends on the agency’s method, and how deeply the adviser is willing to look into it.

“ESG data providers assess only risk,” says Ethical Screening managing director Mike Head.

“When someone looks at a fund that says it’s an ESG climate change fund, they expect it to be addressing climate change. But it’s not. It’s looking at the risk to the organisation of legislation around climate change.”

Head says the data providers have been very clear about this.

“There was a disaster about 18 months ago, where someone did a big gotcha, aimed at MSCI. But its response was: ‘That’s what we do.’”

Does the client understand how the rating agency reached its decision? Do they agree with the way that decision was reached?

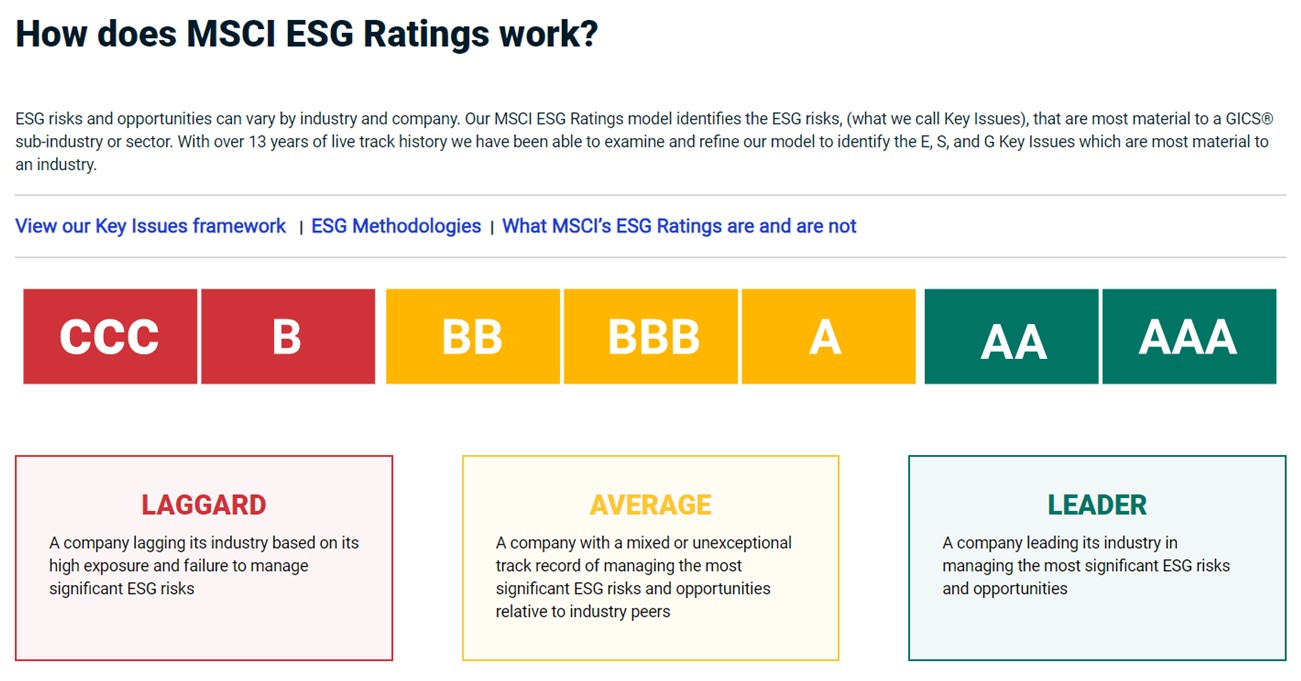

MSCI does make this transparent on its website.

“Our ESG ratings are designed to look at the financial significance of ESG issues,” it says.

It also points out that ESG ratings are not climate ratings.

“If a company’s greenhouse gas emissions pose significant financial risks, its ESG rating will reflect that. For example, direct emissions pose a significant risk to power and steel companies, while emissions from their products after they have left the factory gate can pose a significant risk to automobile companies.

“But, for industries such as healthcare, the most financially relevant risks lie elsewhere, so emissions have less influence on a company’s rating.

There’s an opportunity to cash in. But look at how many companies survive after the FCA starts regulating

“If investors want to understand the carbon footprint of a healthcare company, they can use climate tools that measure emissions more directly. MSCI provides over 500 climate metrics as a complement to our ESG ratings.”

Extreme care

Ethical Screening operations director Matthew Ayres says it is also important to be clear on whether the rating is on the underlying company or the fund, which can be two different things.

If advisers do decide to use ESG ratings, they must be very careful to make sure they know exactly what is being looked at, and how it is being measured.

If you’re comparing scientifically measurable data that you understand and can rely on, it is easy to make a comparison

ESG Accord director Lee Coates warns: “If ratings are being used to mask subjective information, the adviser needs to look through that.

“The danger is that, if everybody relies on these ratings as a statement of fact and assumes there was some science behind it, ultimately the problem will fall on the adviser, not the rating agency. Because the client will say: ‘Where’s your due diligence in checking things?’”

He says a direct comparison would be an IFA who only ever looks at last month’s performance on a fund. They constantly move portfolios around based on which is the best-performing fund over the past month, but do not understand why it is the best performer.

“Safety first for advisers should be: don’t use ratings on ESG and sustainability,” says Coates.

But, he adds, there is a caveat.

“If you’re comparing scientifically measurable data that you understand and can rely on — for example, carbon emissions or the number of women on the board — it is easy to make a comparison.

Safety first for advisers should be: don’t use ratings on ESG and sustainability

“If one fund is saying, ‘The total carbon emissions from our portfolio are X kilograms,’ and another one says, ‘Y kilograms,’ and the client says they want the lower of the two and X is lower than Y, you’ve got your answer.

“You can have a discussion with the client and say, ‘Here are two funds. I’m happy to recommend either. They’re broadly similar but this one’s got lower emissions.’”

However, many ESG issues, especially the ‘S for sustainability’ ones, often are subjective. How a company is judged to impact society is essentially down to a group of well-meaning people, sitting in a room, saying: ‘Well, we think the way they do it is slightly better than the way the other company does it.’”

‘ESG goldrush’

Coates warns about the unregulated nature of rating agencies. The FCA has a taskforce looking at this whole area. The regulator will be bringing ESG rating companies under its remit.

The danger is that, if everybody relies on these ratings as a statement of fact, ultimately the problem will fall on the adviser, not the rating agency

“I call it the ‘ESG goldrush’,” he says. “Everybody, their tennis partners and their granny are all setting up ESG rating businesses, because it is unregulated. It is a free-for-all. You can do what the hell you like. And there’s an opportunity to cash in. But look at how many companies survive after the FCA starts regulating.

“It was the same with claims management companies. All of a sudden, once they started being regulated, the numbers dropped dramatically. And ESG ratings are gonna go the same way.”

The FCA’s new sustainability disclosure rules will require advisers to demonstrate they understand the rating.

“I often say the adviser needs a copy of the minutes of every meeting, and a copy of every internal process manual about how the committee meets and how those decisions are made.

ESG data providers assess only risk

“The adviser then needs to go through that with every client. Not on behalf of clients, because these are subjective decisions; therefore, every client will view it differently. So the client and the adviser need to go through the manual and through the minutes.

“Does the client understand how the rating agency reached its decision? Do they agree with the way that decision was reached? Yes? Then we can use those numbers.”

Until the FCA steps in to regulate these firms, advisers should approach with caution.

Source: MSCI

This article featured in the July/August 2023 edition of MM.

If you would like to subscribe to the monthly magazine, please click here.

Comments