J. Stern & Co is launching the emerging market debt stars fund, which will invest indebt issues by quality companies in emerging markets (EM).

The portfolio adopts an unconstrained approach and consists of 30-50 issuers across Latin America, Africa and other EMs.

The company told Money Marketing that the new fund does not invest in Chinese corporate debt.

This is due to a strong exposure to the property market and concerns around companies’ governance.

The new fund is based on the company’s existing EM Debt strategy. It will invest across several themes such as infrastructure, communication and digitisation.

The company considers that EM corporate debt is safer than EM sovereign debt.

J Stern & Co explained that performance of EM corporate debt mostly relies on the credit and the fundamental strength of the underlying companies.

In contrast, EM sovereign debt is linked solely to the economic health of developing countries and inherent political risks.

J. Stern & Co co-portfolio manager Charles Gelinet said: “Whenever emerging market corporate debt is discussed, many investors associate it with emerging market sovereign debt. However, the risk/return profile of sovereign debt is very different to that of emerging market corporate debt.

“Investors in emerging market corporate debt are paid a higher yield for investing in companies based on the rating of the country they are based in, even if they are global companies with diversified sources of revenue and strong fundamentals.

“Our experience demonstrates that quality companies with strong and sustainable competitive positions, generating predictable cash flow, are in a solid position to repay the debt, regardless of their location.”

In addition, J. Stern & Co said that EM corporate debt compares favourably to other assets classes. It has been one of the more resilient asset classes this year and has generated more than 7% annualised returns for the past two decades.

EM corporate debt vs other asset classes

Source: J. Stern & Co, Bank of America, Bloomberg

The company also identified the asset class to have attractive yields. In hard currencies, the asset class currently bears a yield to maturity of more than 7%.

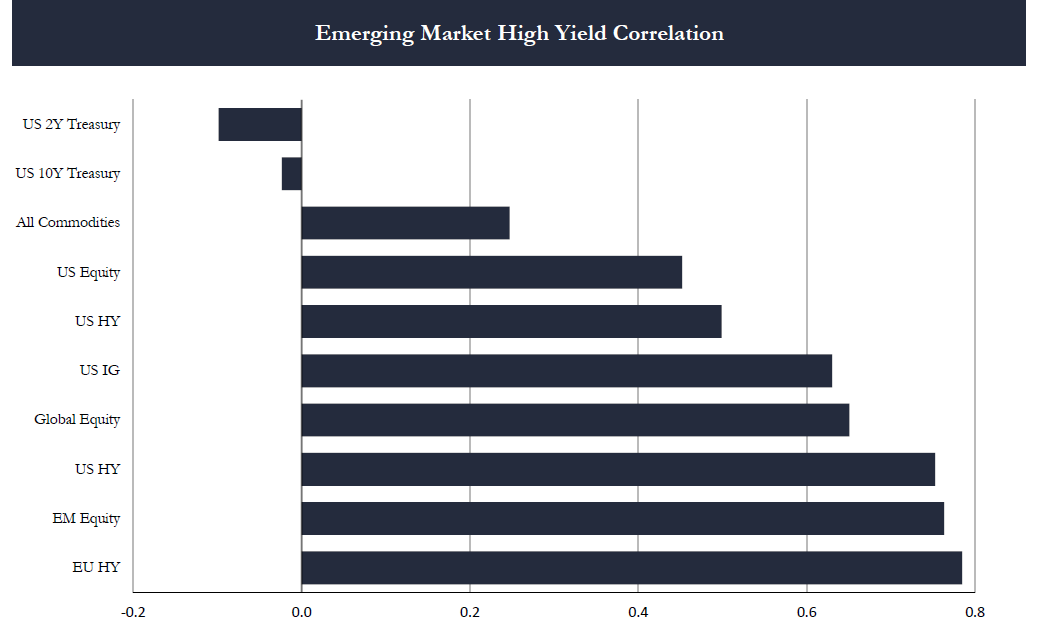

J Stern & Co also highlighted the low correlation with other assets classes. For example, EM has a correlation of only 57% to US investment-grade bonds and 45% to US equities.

It also stressed that default rates of emerging market corporates are comparable with their developed markets peers.

J Stern & Co partner and co-portfolio manager Jean-Yves Chereau said: “The market repricing we have experienced this year has led to higher yields in fixed-income assets.

“We believe this presents an attractive entry point for long-term investors to buy and hold bonds from companies with solid underlying fundamentals, delivering generous income (and total returns) in an environment where the global outlook is uncertain.”

Set up as a Luxembourg UCIT, the fund will carry an annual management fee of 0.9%. It will be managed by a team of five investment professionals, headed by Jean-Yves Chereau and Charles Gélinet.

J Stern & Co will target it initially at intermediaries and DFMs, wealth managers, private banks and family offices.

To eliminate currency-exchange and local liquidity risks, the fund will invest only in hard currency bonds, mostly in US dollars.

Comments