Although attractive in a global context, China’s bond yields are likely to converge with their European market peers.

In fact, China’s bond yields started to decline in 2018. While Chinese sovereign bond yield were hovering around 4% in 2018, they are now below 3%.

Matthews Asia chief investment officer and portfolio manager Robert Horrocks told Money Marketing that an aging population and a tight monetary policy could be the reasons for this fall.

He believes China’s bond yields will continue to decline.

Horrocks said: “I think yields are currently at attractive levels and may fall because they are attractive.

“The key here, given the current environment, is demand domestically within China and potentially from Russia.”

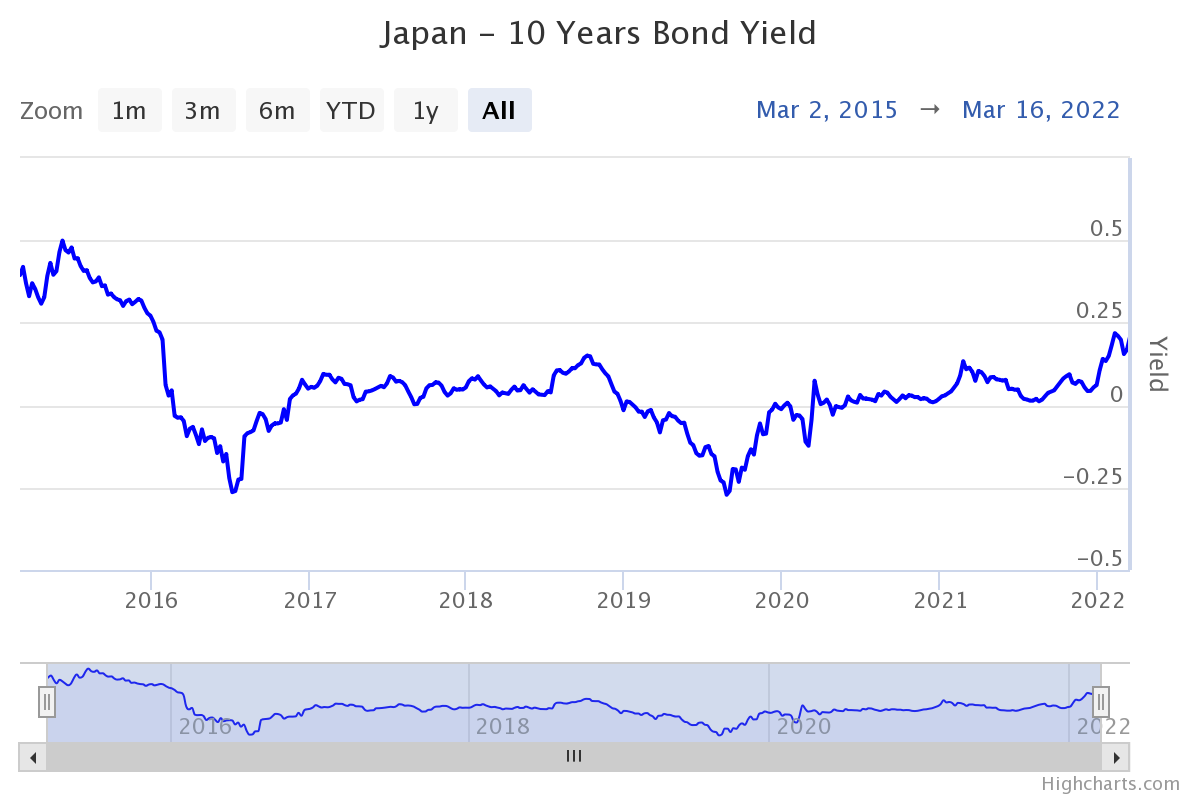

In fact, economists and investors have argued that China may be on the same trajectory as Japan with a low inflation and near 0% bond yields.

In spite of some similarities, Horrocks does not believe China’s bond yields will fall to levels seen in Japan.

“Similarities are the aging population and the overseas investment into places like ASEAN,” he said.

Yet, China has a higher rate of productivity growth and a lower capital stock/GDP rate compared to Japan. It reflects a higher investment demand.

Horrocks also explained that China knows how to deal with this situation.

This is because it can draw experience from Japan’s precedent of sovereign bond yields falling to low levels.

“The trend may be down but unlikely to reach Japan levels,” he added.

As a result, Horrocks expects China to ease its monetary policy.

As of 16 March 2022, the China 10 Years Government Bond has a 2.819% yield. It changed -5.5 bp during last week, +1.1 bp during last month, -47.2 bp during last year.

China Credit Rating

| Rating Agency | Rating | Last Update | Action |

| Standard & Poor’s | A+ | 21 Sep 2017 | Rating downgrade |

| Moody’s Investors Service | A1 | 24 May 2017 | Rating downgrade |

| Fitch Ratings | A+ | 5 Nov 2007 | Rating upgrade |

| DBRS | A (high) | 15 Nov 2020 | Outlook upgrade |

Source: World Government Bonds

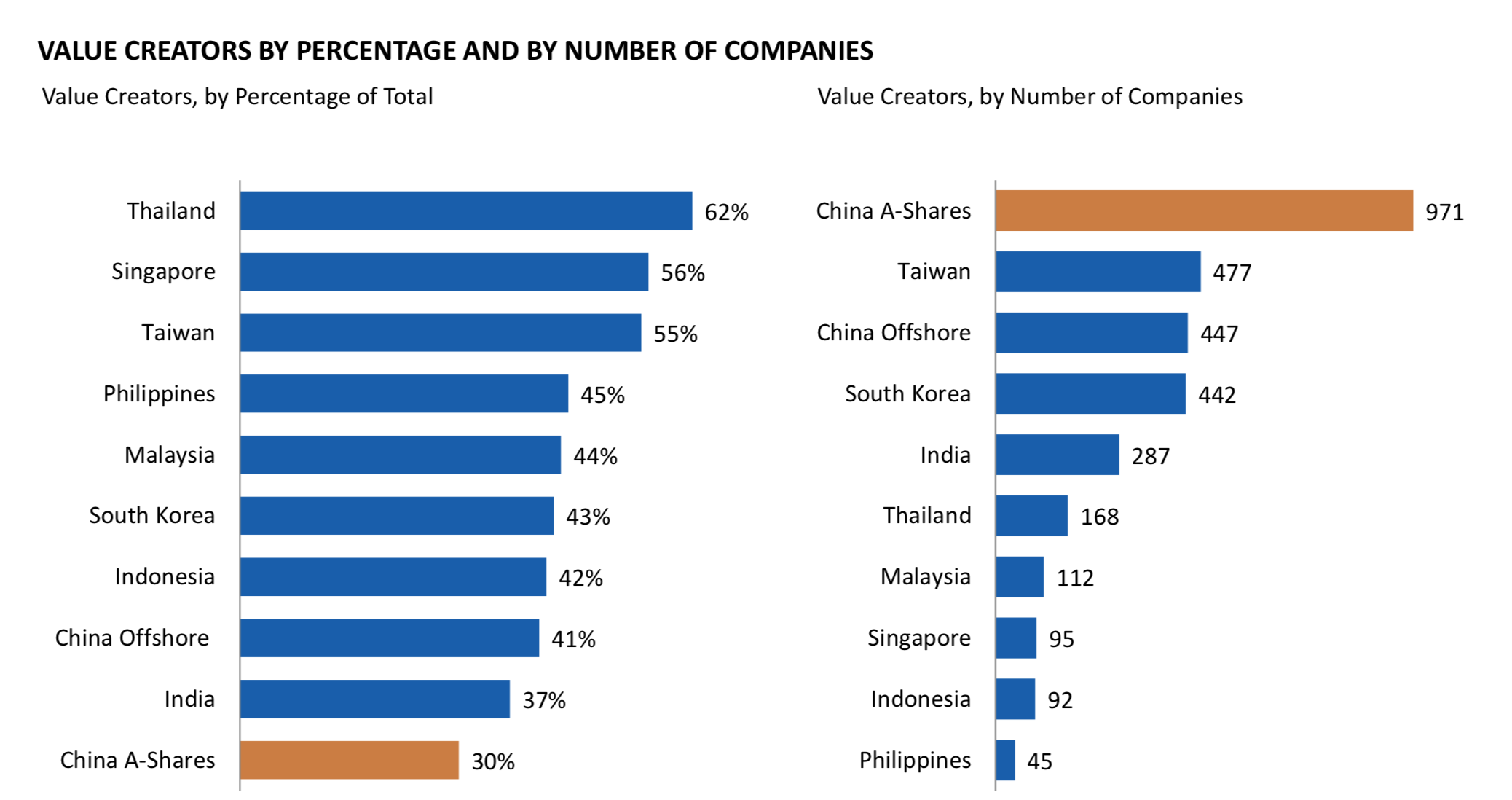

In addition, Matthews Asia found that China is the region in Asia with the highest numbers of value creators in its equity markets.

Yet, the number of value creators compared with the total number of stocks in the Chinese equity markets is lower than in the neighbouring countries.

Horrocks said that it is due to the presence of several poor and unprofitable firms but also of shell companies within the Chinese equity markets.

“It makes it a good place for stockpicking but a bad place for benchmarks,” Horrocks added.

With the common prosperity policy, J. Stern & Co portfolio manager of the World Stars investment strategy Christopher Rossbach believes that China will offer further opportunities to investors.

He told Money Marketing: “The five year plan put in place by the government is going to double the number of middle class people in China from 400 million to 800 million by 2030.

“There are enormous investments, developments, and improvements in prosperity and quality of life still to come in China.

“This is something that we as investors should should view positively. We think that there’s great opportunities for companies to do business in China and to participate in this prosperity that is being created.”

What regulatory crackdowns in China mean for investors

China still applies a zero tolerance policy for Covid-19. This is causing concerns among investors as the Omicron strain is spreading in the country.

Hargreaves Lansdown senior investment and markets analyst Susannah Streeter said: “The rapid spread of Covid across China is now unsettling investors, with expectations that mass lockdowns will once again blight the economy with new daily cases hitting two year highs

“Hong Kong’s Hang Seng dropped 7.9% after 17 million people in Shenzhen were locked down with worries mounting that other cities will follow suit to abide by the country’s strict zero-Covid policies.

“That’s also helped push the oil price lower, with demand expected to take a hit if Chinese economic output falls.”

Comments