Good morning and welcome to your Morning Briefing for Tuesday 12 November 2024. To get this in your inbox every morning click here.

AI will have a greater impact on advisers than ESG, study finds

Research from Downing Fund Managers reveals that AI is expected to have a greater impact on adviser businesses than ESG over the next five years.

Nearly half (46%) of advisers surveyed believe AI will drive efficiency, improve personalised insights, and support automation and analysis.

This compares to 28% who consider ESG investing, which is gaining attention from investors and regulators, as the most impactful trend.

Steve Webb: Should we be concerned about surge in mortgages running into retirement?

It is not often the Financial Conduct Authority comes up with a snappy soundbite, writes Steve Webb, partner at pension consultants LCP and pensions minister from 2010–15.

However, responding to the growth in mortgages with terms running beyond pension age, earlier this year the regulator said such lending was moving “from a niche to norm”.

I think this admirably sums things up. But should we be concerned?

Quote Of The Day

The changes to the NICs threshold are not just unsustainable for our businesses, they are regressive in their impact on lower earners… Unquestionably they will lead to business closures and job losses within a year

– The board members of UKHospitality in a letter to the Chancellor criticising the changes to employer National Insurance Contributions, announced in the Budget last month

Stat Attack

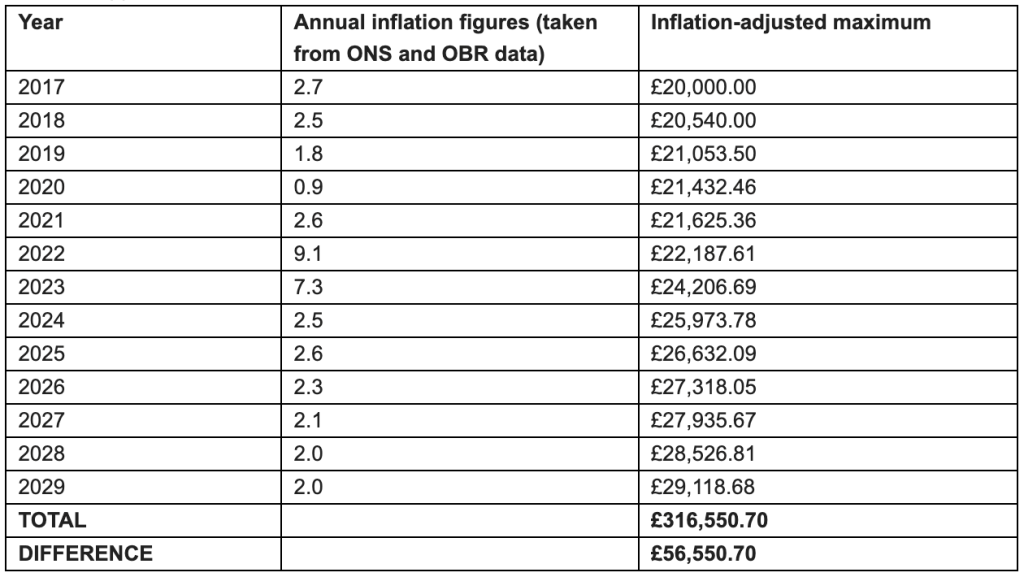

Leeds Building Society has found that 16.9% of people maximised their ISA allowance last year. However, due to the ISA threshold freeze at £20,000 since 2017, which will continue until 2030, savers who consistently maxed their allowance would have an additional £56,550.69 if it had risen with inflation.

The data below has been compiled using the ONS Consumer Price Index figures and OBR predicted inflation figures. For each year, the previous annual inflation figure has been applied.

Source: Leeds Building Society

In Other News

Quilter Cheviot has appointed Maurizio Carulli as an equity research analyst, focusing on the global energy and materials sectors.

Carulli will cover a range of listed companies, from oil giants to those in mining, chemicals, paper, packaging, building materials and steel.

With over 30 years of experience in asset management and stockbroking, Carulli previously worked with Carbon Tracker, where he specialised in analysing fossil fuels, climate change and the energy transition’s impact on capital markets.

Reporting to Quilter Cheviot’s head of equity research, Chris Beckett, Carulli will also collaborate with teams managing the Climate Assets and Managed Portfolio Service Building Blocks funds.

Quilter Cheviot’s research team, consisting of 22 professionals, provides key insights across equities, fixed income, and funds to support the firm’s investment management strategies.

Beckett praised Carulli’s expertise, highlighting the value of his sector insights and thematic experience: “Maurizio’s knowledge will be invaluable, particularly as energy transition and ESG factors remain central concerns.”

Carulli added: “The energy and materials sectors have had a volatile five years, and as such I want to be able to cut through that noise and provide our investment managers with insightful and detailed research.

“Given these sectors’ roles within the energy transition, both the opportunities and the risks are vast and likely to change in very short periods of time. This is a very exciting time to monitoring the sectors and providing research.”

From Elsewhere

Bitcoin soars above $84,000 as Trump win boosts crypto prospects (Bloomberg)

Cop29: which climate finance ideas are most likely to work? (The Guardian)

Trump tariffs could cost UK £22bn of exports (BBC News)

Did You See?

Speaking with an advice firm chief executive recently, she raised concerns about the prospect of a ‘two-tier’ financial-planning sector, writes Natalie Holt, content editor at the lang cat.

She was referring to those in the profession who are using technology to improve client experience and grow their business, and those who aren’t.

It got me thinking about not just the tech haves and have nots, but whether this idea could apply to advice more broadly. Are we in a two-tier advice market, with service depending on the type and size of firm clients work with?

Judging from some of the latest Financial Conduct Authority communications, this is something the regulator is actively monitoring.

Comments