Good morning and welcome to your Morning Briefing for Tuesday 7 February, 2023. To get this in your inbox every morning click here.

Solomon takes Beaufort stake

Solomon Capital Holdings has completed its first minority partnership investment with IFA firm Beaufort Financial Westerham as part of a new hub and build strategy.

The deal gives Solomon a minority stake in the Kent-based advice firm and brings £409m AUA and seven advisers to the group.

Lack of LDI focus

The House of Lords Industry and Regulators Committee has criticised the use of leveraged liability-driven investment (LDI) strategies by defined benefit (DB) pension funds.

LDI strategies played a significant role in the financial turmoil following the September 2022 ‘mini-budget’.

The sharp rise in interest rates forced pension funds to sell assets, often at significant losses. This was to meet the liquidity calls required by the fall in leveraged LDI values.

Brooks Macdonald loses chair

Brooks Macdonald has announced that chair Alan Carruthers has resigned from the board with immediate effect.

The company said Carruthers had suffered from a series of unfortunate health issues over the past twelve months and needs time to “recuperate fully”.

Senior independent director Richard Price will assume the role of acting chair.

Quote Of The Day

The majority of managers believe regulators will be compelled to introduce more stringent reporting requirements as retail participation rises.

– Paul Fleming, head of the global alternatives segment at State Street, comments on institutional investors growing their allocations in private markets.

Stat Attack

As part of their cost-of-living statistics report, the experts at money.co.uk sought to investigate the current cost-of-living’s impact on different age groups.

Six in 10

Of those aged 25-34 have suffered due to the cost-of-living crisis

2 in 5

Had monthly bills as their biggest financial concern

43.58%

When it comes to combating rising costs, 43.58% cut down on their food shop and other essentials

4 in 10

Use less energy in their homes

1 in 5 parents

Aged 25-34 reported an increase of £50 to £100 in their monthly childcare costs, the most of all age groups

10.34%

This suggests why 10.34% have received childcare benefits in the last year

4.86%

Of 25-34 year olds had to rely on a credit card, the most of any age bracket

52.27%

Of 35-44 year olds’ mental health has been affected by the cost-of-living

46.83%

Are concerned about their monthly bills

13.90%

Are also more worried about mortgage repayments than any other group

1 in 5

Used their overdraft to pay for bills, the highest analysed

Source: money.co.uk

In Other News

Aviva Investors has warned companies not to sacrifice long-term sustainability goals in response to near-term challenges posed by energy shocks, supply chain disruption, elevated inflation and the risk of recession.

Its chief exeutive Mark Versey set out the expectation in his annual letter to the chairpersons of companies where Aviva Investors is a shareholder or bondholder.

He said the firm’s stewardship priorities this year will focus on how companies tackle the cost of living crisis, the transition to a low carbon economy and reversing nature loss.

The letter was sent to around 1,600 companies in 31 countries. It outlines ways in which businesses can address these issues.

Aviva Investors will hold boards and individual directors accountable at companies where the pace of change against these priorities is too slow.

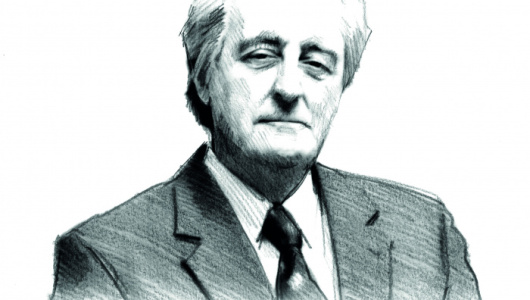

Micro-investing platform Wombat has appointed Richard Charnock to its board of directors as it gears up for expansion into Europe after surpassing 300,000 users in the UK.

Charnock formerly was CEO for discretionary management at abrdn and joins Wombat as non-executive director.

He retired from abrdn in May 2022 after leading the discretionary business for 15 years.

Charnock has more than four decades’ experience in the wealth and asset management space.

In addition to abrdn, he previously served as CEO of Williams de Broe and CEO of Lloyds TSB Private Banking, Lloyds TSB IFA and Lloyds TSB Stockbrokers.

From Elsewhere

Google announces Bard A.I. in response to ChatGPT (CNBC)

Rishi Sunak poised for mini-reshuffle after Nadhim Zahawi’s downfall (Financial Times)

Crypto exchange Bitvavo eyes 80-100% recovery in DCG deal (Reuters)

Did You See?

AI tech is advancing at a rapid pace – fuelled by a rise in both interest and investment. And people are working on making it act and seem more human. To me, this is a terrifying thought. Have they never seen Terminator?

“If you start using AI and bots with deep fake technology, how hard would it be to come up with a visual manifestation of Siri, for example?” asks FTRC director Ian McKenna. There’s already a hologram at Heathrow Terminal Five of a BA staff member guiding people towards the next train. And apparently there are small robots at San Juan airport which you can ask for directions.

As for further in the future, McKenna says that even five years ago there were at least half a dozen projects around the world looking at how to map people’s brain waves, in an effort to understand their propensity to certain the sorts of behaviours.

Comments