The recent market volatility has caused many investors to reassess their convictions and take a closer look at where they are taking risk, given some areas of the market have been looking overcrowded for some time.

One area of the market we have been adding to over the past quarter is UK equities, which has long been an out-of-favour region. We believe there are compelling reasons why UK equities should outperform in the coming months.

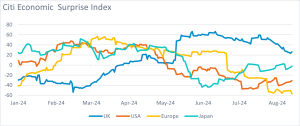

Looking at the macro picture, the UK’s growth outlook is now improving after a slowdown last year. The UK recorded solid growth of 0.6% in Q2, following 0.7% in Q1, driven by strong consumer spending and services output.

Recent employment data has been surprisingly strong and consumer savings rates are increasing too, which should further support growth next year as consumer sentiment grows and savings get converted into spending.

Chart 1: UK economy improving over the summer

Source: Fidelity International, LSEG Datastream, August 2024.

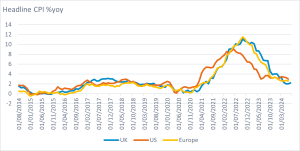

Recent inflation news has also been more encouraging. For much of the past few years, UK inflation has appeared to be stickier and more difficult to get under control than many other regions. Headline inflation is now well under control.

Although services inflation is still too high for the Bank of England to feel too relaxed, there has even been some positive news on this front, as it fell from 5.7% to 5.2% in July. We expect one more rate cut this year, but the direction of travel of interest rates is now clearly downward, which should provide a boost to the UK economy.

Chart 2: UK inflation under control

Source: Fidelity International, LSEG Datastream, August 2024.

Elsewhere, some optimism is returning to the M&A sector. Deals are now being completed at premiums as corporates look to take advantage of this. The UK market has long been unloved and valuations are still some of the most attractive in the developed market universe on a range of metrics.

The UK has a natural value bias from its higher weighting in sectors such as materials and energy and lower weighting to technology, but, even taking this into account, UK equity valuations are compelling.

Chart 3: Valuations in the UK remain compelling

Source: Fidelity International, LSEG Datastream, August 2024.

Finally, the UK general election in July resulted in a significant Labour victory. We believe this should result in a period of greater political stability without major policy differences that could attract foreign capital back to the UK.

Within UK equities, we prefer mid-caps as they have more exposure to the better fortunes of the UK economy – UK large-caps derive a significant portion of revenues from overseas. We also have a bias for strategies that find undervalued stocks.

On a broader view, we are looking for opportunities in areas with potential for growth but valuations are not yet stretched. Despite the recent market gyrations due to fears of an impending US recession, we still believe the US presents one of the better opportunities in global equity markets.

The US economy still looks on track for a soft landing. While growth is certainly cooling, it is still robust enough to justify confidence for now that a recession is not just around the corner.

In emerging markets, China is still grappling with structural changes and a challenging macro picture. There has been increased evidence of policy support, including several People’s Bank of China rate cuts. However, these seem more designed to stabilise the economy as opposed to encourage fresh growth. Rising valuations in India and political uncertainty in Brazil have reduced our conviction on equities there.

Chris Forgan is multi-asset portfolio manager at Fidelity International

Comments