Germans went out to the poll stations on Sunday to elect its new federal government. For the first time in 16 years, Angela Merkel was not running in the election, it marks the end of an era.

Despite being Europe’s largest economy, German elections fail to attract the international interest and this year was no exception.

“German politics in general might lack the thrill and glamour present in other European countries,” says M&G Investments fixed income fund manager Wolfgang Bauer.

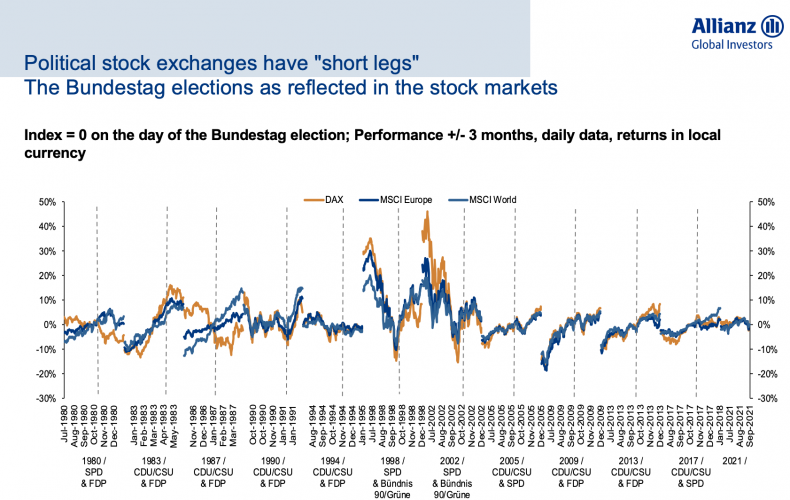

In fact, German Federal Elections rarely cause any significant movement in the market. DAX, the German stock market index, tends to follow the MSCI Europe and MSCI World indexes in electoral periods.

Since 1980, the DAX index has usually not decoupled from MSCI Europe and MSCI World in the three months before and after a federal election in Germany.

Bauer deplored the lack of interest from market participants ahead of the election as there were fears that drastic changes were around the corner.

“Market participants seem to be paying surprisingly little attention to the upcoming federal elections. This could however backfire as, judging by the latest opinion polls, a change in German politics is looming ahead,” he said.

DWS chief economist Europe Dr. Martin Moryson explained to Money Marketing that there were two risk scenarios prior to the election.

The first one would have been a coalition made of the SPD (Social Democrat Party, centre-left), die Grünen (the Greens), and die Linke (the Left, far left).

“This coalition would have been market unfriendly and probably not been good for the equity markets,” said Moryson.

The other risk scenario would have seen a coalition between the CDU (Christian Democrats, centre-right) and the FDP (Free Democratic Party, classical-liberal).

“If the CDU and the FDP would have had a majority together, there might have been a risk scenario for the bond markets,” said Moryson.

Both the CDU and FDP are in favour of austerity and the latter advocates for a stricter debt limit both in Germany and in the whole European Union. Moryson added that it would have been very difficult for many countries.

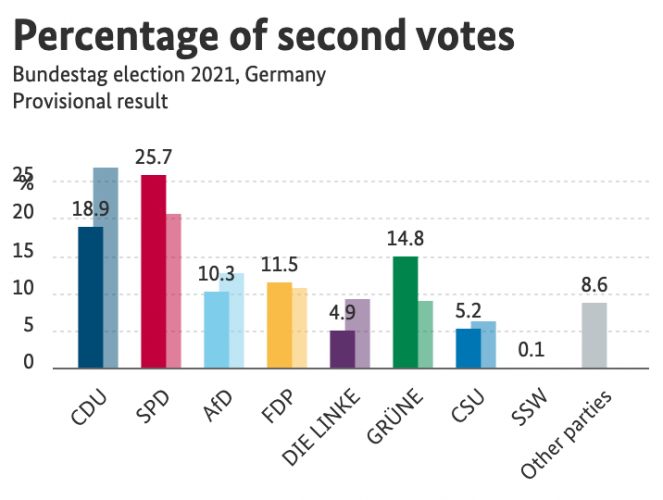

Those risk scenarios, however, did not materialise. The SPD came out on top with 25.7% of the, followed by the CDU, which with the addition of the votes obtained by its Bavarian sister party (CSU), gathered 24.1% of the votes. With 4.9% of the votes, die Linke did not garner enough support to qualify as a likely coalition partner.

“What we have seen on Monday morning was a relief, because the hard left seems to be off the table,” said Allianz Global Investors senior investment strategist Dr. Hans-Joerg Naumer.

There are several possible options to form a coalition, but any coalition involving a “Grand Coalition”, a coalition including both the SPD and the CDU, seems very unlikely.

Although they agreed to govern Germany together after the federal elections in 2017, both parties have stressed that they would not renew their alliance.

The “Traffic Light” coalition is made of the SPD (red), FDP (yellow), and die Grüne (green).

The “Jamaica” coalition consists of CDU (black), FDP (yellow), and die Grüne (green), which are the colours of the Jamaican flags. There were attempts to build this coalition after the 2017 elections, but the FDP left the negotiations table.

Essentially, the difference between the two coalitions is whether Olaf Scholz (SPD) or Armin Laschet (CDU) will be at the helm.

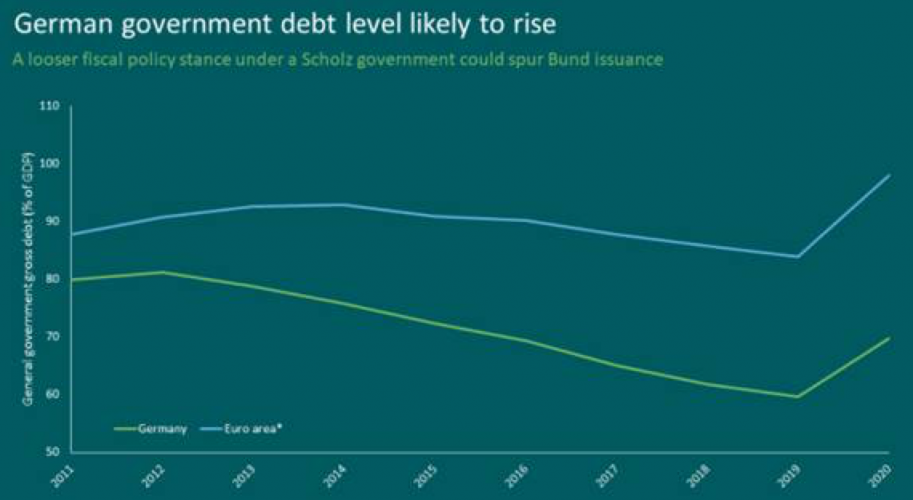

“Traffic light is a little bit more left wing. This coalition would be more inclined towards fiscal spending, deficit spending, and redistribution, but the FDP, as a very liberal party, would have a major role to play,” said Allianz’s Naumer.

Yet, the SPD proved by the past that it can create a good environment for the market.

“If the experience of the Schroder-led government, which led to market friendly policies, in particular the Hartz reforms, which reinvigorated the German economy from the mid- 2000’s onwards, is anything to go by, there is no reason to reflexively fear an SPD-led coalition,” said GAM investment director for European equities Niall Gallagher.

While the current German political framework should not go through drastic changes, the next chancellor will have several economic issues to address.

“Numerous areas of policy in Germany have not been well handled over the past few years, particularly in energy transition where Germany is shortly to phase out carbon free nuclear power while still burning large amounts of lignite to generate electricity, potentially until 2038,” said Gallagher.

Climate change is a point all parties that could be involved in a coalition want to tackle. Besides, Germany has set itself the target hit net zero by 2045.

Digitalisation is another area that the next chancellor will try to improve. DWS’s Moryson said that the pandemic made Germany’s digitalisation gap all the more obvious when working from home became a necessity.

Another issue for Germany is the ageing of its population.

Moryson said: “Roughly 10% of the working age population is going to be lost in the coming 10 years.

“There will be some compensation from migration, but at the moment, migration is not compensating enough. Germany’s population is shrinking.

“One of the problems is that you have more and more pensioners, but less and less people to pay for them.

“The other problem is that productivity is coming down, because ageing societies are less open to innovation.”

As a country where exports of goods and services represented 43.82% of its GDP in 2020, the tension between China and Western countries is also problematic for Germany.

Tatton Asset Management chief investment officer Lothar Mentel told Money Marketing: “It is very difficult for Germany to navigate its relationship with China. As an export-driven economy, Germany is very dependent on China.

“The Western world generally is taking a step back and distancing itself a bit from China, which is very hard to do for Germany.”

But let’s not get ahead of ourselves, it will take weeks until the coalition talks end. As a reminder, it took nearly six months for Angela Merkel to form a new government after the elections in 2017.

“The only certainty near-term is uncertainty. As far as settling the German political outcome, today’s election is really just the end of the beginning, and horse-trading between the main political parties is now expected to jump up a gear or three,” said Brooks Macdonald investment strategist Matthew Cady.

Comments