Financial advisers find regulations a worse burden than Covid-19, volatile markets, and Brexit, according to a new study.

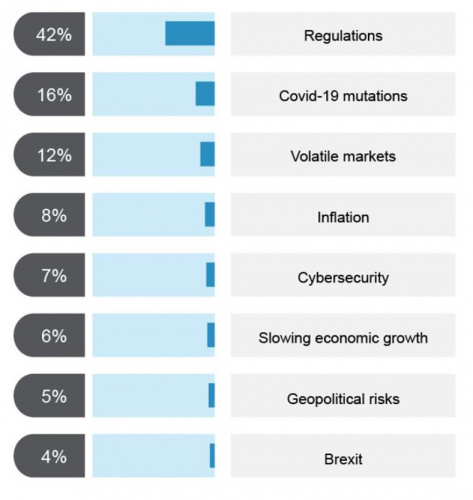

The survey by CoreData Research found advisers consider regulations – cited by nearly half of respondents (42%) – as the biggest threat to their business over the next year.

This is significantly higher than those pointing to the challenge of Covid-19 mutations (16%) and volatile markets (12%).

Fewer than one in 10 advisers said they thought inflation (8%) cybersecurity (7%) and slowing economic growth (6%) would be the primary challenge over the next year.

Geopolitical risks (5%) and Brexit (4%) are even lower down the list of concerns.

CoreData founder and principal Andrew Inwood said the results of the survey show “just how much of a concern [regulations] present”.

He pointed out that advisers have had to get to grips with product governance and MiFID II rules.

Now, he said, they must turn their attention to the likely introduction of environmental, social and governance rules similar in scope to the EU’s sustainable finance disclosure regulation.

What is more, the Financial Conduct Authority has set out plans for a new consumer duty. This means advice firms face an “increased regulatory burden” if they are not adequately prepared.

Chris Gilchrist: Retail financial services demands simpler regulation

In June, the Taskforce on Innovation, Growth and Regulatory Reform published a report setting out more than 100 recommendations for how the UK can reshape its approach to regulation.

These include making “sensible changes” to pensions and insurance regulation, such as allowing pension schemes to invest in start-ups.

Of course. Regulationism is a racket. It’s a form, an insidious and deceitful form, of ‘central planning’.

Whereas, the free competitive market working under the rule of law and with sound money always trends to order, peace and prosperity. Bureaucrats, entirely self serving, relatively ignorant and late to the party, always create chaos in that spontaneous order. Their ignorance combined with their arrogance (which I have witnessed) is a toxic combination.

Shut it down.

I have two points to make here. Firstly I don’t believe the regulator will take a blind bit of notice of this or the impact of their regulatory failures. They seem to be completely oblivious of the fact that regulatory failings push up costs for everyone which includes the clients. Secondly, is anyone really surprised because the only thing that surprises me is only 42% of advisers have cited this as their primary area of concern. This figure is however greater than the next 3 combined. Anyway, back to the grind as I’ve got increased regulatory fees, PI Costs & compliance costs to meet. Living the dream

The unbalanced system manipulated by those in power to suit their required outcomes.

Agree totally with Steven Farrall, I have been stating for 2 decades that the rule of law should be applied by the FOS and FSCS. That the system is broken, guidance with hindsight judgments is not regulation.

Of course, they are a burden and little wonder. This huge and highly paid staff immediately have a bureaucrat’s attitude – concentrating on the minutia rather than the big picture – which is protecting clients. They try to justify their stipends by getting involved in all kinds of extraneous topics that have little to do with investor protection, EG Diversity and ESG. Logic also doesn’t seem to be a strong suit. On the one hand the mantra is that investing is a long-term thing, yet they expect quarterly valuations and daft letters if the market plunges. What do they do about those who trade on line who in fact don’t invest but gamble? Then of course there is gambling itself. What is there input here? Nil. After all gambling is concerned with money and that presumably should fall under their remit. Then finally their much-vaunted independence is nothing but a sham. They do as the Treasury and the government tells them.

Aaaaarrrrgggghhhhh.

Steve and John, you are both right. Of course if you look back over, in my case, over 30 years of regulation with Nasdim, Fimbra, PIA, FSA, FCA, a survey like this in many ways is a waste of time.

Regulation is a law based form of perpetual motion.

On average a regulators shelf life has been 6 years. When one goes the next picks up the baton looking to make running IFA businesses more complicated because…….well they need to be seen to do something their predecessors did not, even if it makes no sense.

What is missed in every case is the chance to simplify, less is more.

Treating customers fairly should not involve pages of legal stuff. A simple addition of text along the lines of ‘and don’t be a greedy, devious, self serving dick…d should suffice.

We all know what that looks like, punishment for ‘dickh…ing’ should be severe, quick and non reversible.

Simples, and you don’t need a survey to tell you that.

Sorted!

After 36 years of regulation, it’s refreshing to see that outright rejection of the need for robust regulation of the financial services sector is now a minority sport. I think most sensible practitioners recognise that regulation isn’t just there for the benefit of consumers but the protection of firms from unfair competition. Without regulation, serious financial advice would effectively be forced back to the lowest common denominator of caveat emptor based sales. In my experience, more than 45 years, I have typically found regulators to be pragmatic, helpful and generally fair, except when dealing with those who’s attitude and approach is otherwise. I also place great store in the ability of the UK financial services regulator, not just to do deal effectively with complex and fast moving market but to evolve accordingly. They deserve all our respect and support.

I could not disagree more.

Let’s suppose I have reviewed a clients portfolio and find that one fund is under-performing for some time, or there has been a change of manager, or investment conditions. I recommend a move to an alternative fund that may be similar but managed by another fund manager. To make the change, I have to update the financial review, complete an ‘attitude to risk’ questionnaire if one was not completed in the last 13 months, complete full analysis on their existing holdings to make sure the portfolio remains within their risk tolerance, carry out in-depth research on the new fund, prepare a personal illustration, and provide a KIID, fund fact sheet, and other supporting documentation prepare a 14-18 page fund switch letter of recommendation, which now includes almost two pages on ESG, provide a Terms of Business, Guide to Our Services, and client privacy statement, and carry out money-laundering checks even though I have been the client’s adviser for more than 20 years. I then have to arrange the fund switch and get the client to sign an ‘authority to proceed’ form. On top of this, I have to provide an annual statement of costs and charges statement to all clients where I receive an ongoing advice fee, together with an annual suitability of advice letter. The result – a forest of paperwork, of which the client is unlikely to read. For this ‘service’ the network I am part of takes 40% of my fees, in addition to some other monthly costs. None of this helps the client from the unscrupulous adviser who advises on unregulated products, or those who charge 1% trail fee despite the fact they have placed the client’s business with a DFM, or a risk-rated Prufund account. The only beneficiaries of this burdensome regulation are those ‘tick-box mentality’ individuals in compliance and in charge of the broken quango’s of the FCA and FOS. Did their oversight stop the London & Capital, Arch Cru, KeyData, or British Steel Pensions debacle? I think you know the answer. The whole advice process requires a complete rethink, as the costs of proper, independent financial advice has become prohibitive, resulting in only those with reasonable wealth able to afford advice. Spending more than 60% of my time satisfying compliance was not the reason I entered the industry in 1996, it was to better my client’s financial position through each stage of lives, no matter their wealth. This is no longer possible under the present system.

The issues you mention appear to have more to do with your network’s application of the rules than anything in the rules themselves. However, that’s the price you pay for delegating responsibility for understanding compliance to someone else. Furthermore, as an adviser, compliance is your duty and responsibility. It describes everything you should be doing in relation to your clients and the running of your business. Hence, spending only 60% of your time on it may point to the challenges you are clearly facing in balancing client interests with your own. Very little of what is in the rules doesn’t otherwise describe how a profitable and efficient business should operate. The problem is that too few of those running businesses take the time to read and properly understand them.

The FCA itself should be regulated, starting with forcing it to abide by the precepts of the Statutory Code of Practice for Regulators https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/301133/file45019.pdf (and not the disgustingly bowdlerised later version).

I am just going to quote …

“The FCA must reject the idea that every time there is a crime committed, that it is the regulated as a whole who is guilty not the lawbreaker !”

The FCA must restore the resect of the advice community that each individual is responsible for there own actions.

Collective punishment is not acceptable at any level, we are “NOT” jointly or severally liable for each other.

Note -: when I say crime I do mean any miss-selling, scams, broken rules, or churning en-mass.