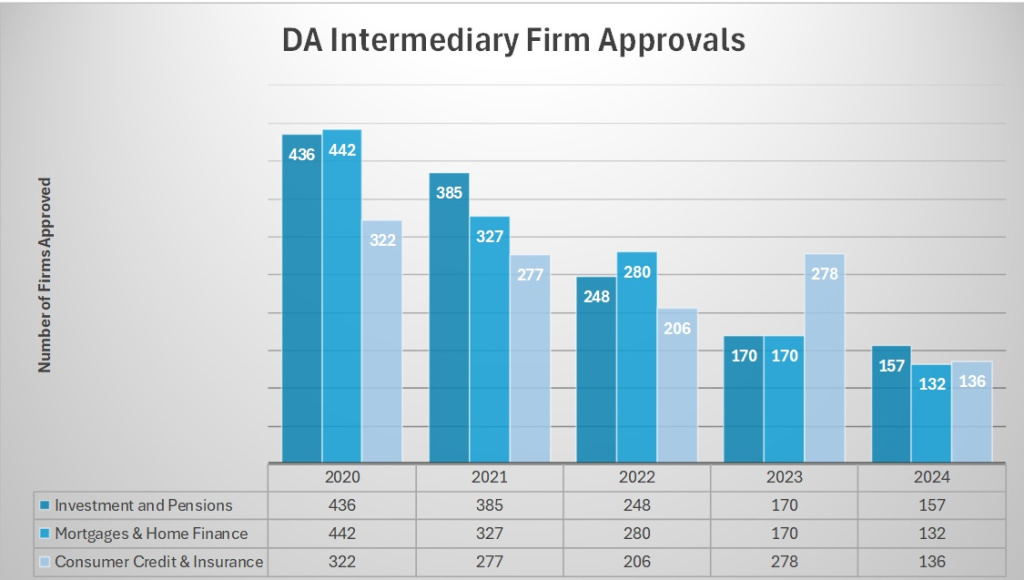

Applications for direct authorisation (DA) are on the decline, data obtained from the Financial Conduct Authority and seen by Money Marketing has revealed.

A Freedom of Information (FOI) request submitted to the regulator by Network Consulting founder and director Paul Day discovered there has been a 64% drop in DA application approvals in the past five years.

In his FOI request, Day asked how many applications for firms to become DA have been approved for each of the past five years in three areas.

These were investment and pensions, mortgages and home finance, and consumer credit and insurance.

Day suggested the two main factors contributing to the fall are the introduction of the Consumer Duty and the changes to the application process, making it a more arduous process than it has been in previous years.

He said this was an “educated guess” and “we’d need to speak with all the would-be DAs that have put the move off to understand this fully”.

He also requested data on the total number of current individual intermediaries that can advise on the mortgages and investment and pensions.

It showed there has been a relatively steady increase of financial planners with permissions to advise on retail investments across all sectors of the industry, including both DA and appointed representatives (AR) between 2013 and 2023.

“From this,” Day suggested, “we could assume that the growth area is attributed to the appointed representative space, but I’m not so sure this is entirely conclusive.”

| Year | Retail Investment Advisers |

| 2013 | 34,429 |

| 2014 | 34,820 |

| 2015 | 34,316 |

| 2016 | 34,357 |

| 2017 | 34,876 |

| 2018 | 35,568 |

| 2019 | 36,279 |

| 2020 | 36,252 |

| 2021 | 36,330 |

| 2022 | 37,129 |

| 2023 | 37,023 |

The adult population of the UK is estimated at around 68.3 million …

And 37,023 advisers ..

Crikey we could all have round about 1.75 million clients ?

Sharpen ya pencils ….

Seriously though …who in their right mind wouldn’t get out if they could …. So who the bleedin heck would want get in ?

Leave the advice to the man, woman, it, that and frying pan in the pub !!

Mind you the price of a pint now means the audience is getting smaller and smaller….pub advice will have to go door to door just like the ole days ….

@ DH – Spot on sir. And i thought it was just me who’d had enough & thought like that!

Who in their right mind wants to complete the massive pointless levels of documentation & reporting requirements (financial resilience survey, nil advice ledger & client vulnerability reporting as 3 off the cuff none earning examples) and be involved in an industry thats controlled & regulated by the inept!

A regulator that’s telling you to look after vulnerable customers and then in the next breath disengage with customers if you don’t fulfil their annual review criteria.

A regulator that’s cast adrift the low earners of our society by their continual hiking of workload and documentation and the associated costs that brings. (When did you last do a regular premium savings?)

With 45 years worth of experience I’ve generally found people don’t go out of their way to save so need advice & guidance to invest in the markets to hopefully achieve a better return on their hard earned cash. ( think about how yesterday’s savers got to be todays investors.)

The workload, the lifetime risk of the advice, the ongoing costs and the mind numbing completion of the pointless regulators documentation will, in my opinion, see is a continual reduction in advisers from the industry which will then see Joe Public left to their own devices and be mainly invested in cash.

Yet, when asked to provide copies of the legal advice it had sought and received as to the legality or otherwise of unilaterally cancelling the longstop, the FSA refused, on the grounds that such a request was not covered by the FOI Act. It made no attempt to prove the veracity of this claim though, from which I think we can draw our own conclusions.