“Most of our content will come from our Money Marketing Interactive conference tomorrow, but please do keep an eye out for what is going on in the wider financial advice space.

“Most of our content will come from our Money Marketing Interactive conference tomorrow, but please do keep an eye out for what is going on in the wider financial advice space.

“Of course, if something happens like SJP scrapping its exit fees, we will need to cover it.”

Full disclosure: I’m not sure the quote is verbatim. But it was words to that effect I said to MM’s new news editor, Dan Cooper, and our chief reporter, Lois Vallely, on 16 October.

Oh, how we laughed.

I didn’t tell them I had typed out the following intro a few days earlier: “St James’s Place will remove its controversial exit fees as part of an extensive overhaul of its charging structure.

Any steps made by SJP in the right direction should be celebrated

“The move appears to have been prompted by the Financial Conduct Authority’s increased focus on fair value for customers as part of its Consumer Duty work.

“SJP held firm with its charging structure when the FCA first revealed its proposals. But, having come under increased scrutiny in recent months, the firm has had a change of heart.”

SJP chief executive Andrew Croft: View from the top

The morning of our flagship event — MMI London — rolls around and guess what happens? We receive a press release on behalf of the advice giant, announcing changes to its charging structures.

This overhaul includes the removal of what SJP calls “early withdrawal charges” (EWCs) — it doesn’t use the term ‘exit fees’. We do, though, as do many others including the FCA.

My speculative intro got put to use before we had welcomed the first MMI delegates through the door at 155 Bishopsgate in the capital on the morning of 17 October.

We are rebalancing our charges so that they better reflect the value clients see

Lois kindly delved in further to the rest of the details contained in the release, so we could get the initial news story up online.

What a start to the day. The topic came up a few times throughout the conference as the audience and our speakers digested the fact we were truly beginning to see the Consumer Duty in action.

And all within just a few months of the 31 July implementation date.

Editor’s view: SJP and FCA can’t do right for doing wrong — but where’s the balance?

But are things moving as quickly as they seem to be? Well, although SJP has revealed its intentions, it doesn’t appear to be in a particular hurry.

The changes won’t be coming in until the second half of 2025 — another two years.

SJP says it is ensuring it will “continue to have a sustainable and competitive charging platform for the long term.”

Shareholder pressure will have played a role in SJP’s actions

It suggests the charges will offer “simplicity, comparability and a continued focus on value for clients”.

Others will argue it should be introducing the changes immediately. Many more will say SJP could have acted years ago.

‘Only 12 years late’

Some readers of Money Marketing have welcomed SJP to the world of RDR (Retail Distribution Review) — suggesting the firm is “only 12 years late to the party”.

Then, of course, we have to consider the fact the changes the firm talks of, in terms of its EWCs, seemingly apply only to new customers.

So there’s plenty of food for thought there on just how fair or good value that is for existing clients within the six-year “gestation period”.

Hopefully, the fact SJP is making changes will remove some of the negativity across the board

The firm has sought to clarify some “misconceptions” since the announcement. It appears the EWCs will tail off eventually. But questions remain. Could customers still feel trapped?

On social channels there have been discussions as to whether the news should be seen as a positive move for the advice world.

Sean Banks, a financial planner at Herbert Scott, posted on X: “Like it or not, SJP is the lens through which many people view the financial planning/wealth management profession.

“Any steps made in the right direction should be celebrated. Regulation apparently doing its job.”

Personal Investment Management & Financial Advice Association (Pimfa) head of public affairs Simon Harrington challenges this view and questions whether those outside the financial advice world are as interested as those within it think they are.

This is a much cleaner fee structure that will be more transparent for clients. They will know exactly where they are

He replied to Banks: “I don’t think this is true. I think SJP is the lens through which people who work in financial planning/wealth management think they are viewed.

“The idea that the various vagaries of charging structures are discussed and understood by the wider public doesn’t register.”

Interestingly, back in late January 2022, MM learned SJP had decided to drop the ‘Wealth Management’ part of its company name in a bid to better communicate its offering. It was part of a revamped brand image — the first upgrade since the firm had been established in 1991.

What changes are coming, then?

SJP has carried out an internal evaluation of its charging structures, which will result in a revised pricing model for most new investment bonds and pensions.

Some of the charges will start to come into effect from 2024. It’s just the whole transition will be in 2025

The firm says these will operate with “an initial charge and ongoing charges applicable from the outset and without any EWCs or gestation period”. It highlights this is already the case with its unit trust and Isa business.

SJP also revealed plans to unbundle its costs so customers can tell what they are paying for. This means charges across all its wrappers, which have historically been disclosed “primarily on an all-inclusive basis”, will be separated into components. These will comprise initial and ongoing advice, investment management, and product administration that will be tiered for larger investment.

“We are rebalancing our charges so that they better reflect the value clients see across each element of our proposition,” the company adds.

SJP says the changes have “naturally” involved engagement with its key regulators.

If this has been brought about by the Consumer Duty then I think the Consumer Duty is doing exactly what it’s designed to do

The FCA wasn’t prepared to go into detail about what discussions with SJP or specific firms had entailed. But the regulator has put a lot of weight behind the Consumer Duty so I’d hazard a guess it came up in conversation a fair few times.

SJP suggests its “continued focus on value and outcomes for clients is consistent with the expectations of the Consumer Duty”. It’s confident its changes will “work well” for clients.

The company highlights that the external environment has evolved and is now increasingly seeking simple comparability of all advice, investment management and other services on a component-by-component basis.

SJP claims clients will see “enhanced value” from the changes with reduced overall ongoing charges for existing client investments across the firm’s core product wrappers.

It is increasingly evident that consumers are seeking simple comparability

Has the company been backed into a corner and realised there is no way out from the increased scrutiny the Consumer Duty brings?

Previously it appeared to be under the impression its charging structure would not be affected by the principles-based regulation.

What is ‘unreasonable’?

The FCA has made it clear financial services firms must avoid charging “unreasonable exit fees” because they discourage consumers from leaving products or services to get a better deal elsewhere.

What commentators may argue the regulator hasn’t been so clear about is what constitutes ‘unreasonable’.

So, in theory, individual firms could say they deem their exit fees to be ‘reasonable’ and that would be the end of it.

The charges will offer simplicity, comparability and a continued focus on value for clients

In practice, it seems that’s not the case. At the very least we know firms would need to justify the reasons for such fees, and maybe that’s easier said than done.

A spokesperson for the FCA tells MM: “The Consumer Duty sets higher and clearer standards of consumer protection in financial services. We recognise that some firms have needed to make significant changes to their business model to improve customer outcomes.”

The changes announced by SJP are extensive and demonstrate the impact the Consumer Duty can have for the benefit of consumers. Make no mistake — the regulator will monitor how those changes are implemented and any effect they have on clients.

And, despite some suggestions the Consumer Duty was introduced purely to change the ways of SJP, the FCA will be keen to see what plenty of other firms decide to do.

Who knows? We may even see this date brought forward if testing goes better than expected

Could SJP’s actions cause a domino effect, with more firms following suit? Once SJP unbundles its costs for a clearer comparison, could other companies come under pressure for being more expensive? The FCA isn’t looking to remove the competitiveness of the market but other practices may be called into question.

Consumer Duty Alliance chief executive Keith Richards tells MM charges across the whole of retail financial services have been under the spotlight for many years.

He says: “Changes in value and methodology can be tracked throughout the past two decades, and further change as a result of the Consumer Duty focus is likely to continue over the coming year.

“Consumer bodies and regulators have been seeking greater transparency and comparability of charges across retail financial services for many years. There is certainly plenty of discussion among advice firms over moves away from ad valorem to other structures, such as fixed fee or time-costed hourly rates.”

I suspect SJP had already recognised the need to transition all clients to the new charging structure once implemented

Richards adds: “The changes to fees and exit penalties announced by SJP recently are very welcome and unquestionably positive early results of the clear focus on the Consumer Duty outcomes, rather than compliance with regulatory rules, which I believe will ultimately benefit the firm, its clients and indeed the wider sector in the long term.

“Whether from regulatory pressure, self-assessment or being under the media spotlight, there is no doubt that shareholder pressure will have also played a role in addressing a long-standing criticism of SJP’s uniquely different charging position as both manufacturer and distributor, fair or otherwise.”

Richards also shares his views on the speed with which SJP plans to implement the changes.

“While some criticism has been levied regarding the implementation timeframe of proposed changes, as well as the suggestion of differential treatment between new and existing clients, it is not unusual for large, vertically integrated firms, or of course platforms, to have to plan and backtest IT system development and align with process changes. Who knows? We may even see this date brought forward if testing goes better than expected.

The changes will reduce the underlying cash result over the next few years before growth accelerates

“I suspect SJP had already recognised the need to transition all clients to the new charging structure once implemented, but it hasn’t quite articulated this point clearly — something I am sure will be rectified.

“There has been no let-up in Consumer Duty activity over the summer months and the coming months look set to become just as busy as the sharing of good practice, FCA assessment and thematic work is likely to drive further action. As with the RDR, for many firms the Consumer Duty has served to accelerate change already in progress.”

Brand reputation

SJP states its charges “will continue to compare favourably with competitor rates available in the marketplace”. It claims this represents “good value for the high-quality service” it provides alongside its partners.

“This will support our brand and reputation in the marketplace, which will, in turn, benefit the partnership,” the firm says.

Consumer bodies and regulators have been seeking greater transparency and comparability of charges across retail financial services for many years

But SJP does acknowledge such changes could result in some pain for shareholders in the short term.

It says: “For shareholders, these changes and the associated implementation costs will affect the shape of the cash result in the future. The changes will reduce the underlying cash result over the next few years before growth accelerates over the medium term and beyond, aligned with the development of total group funds under management.”

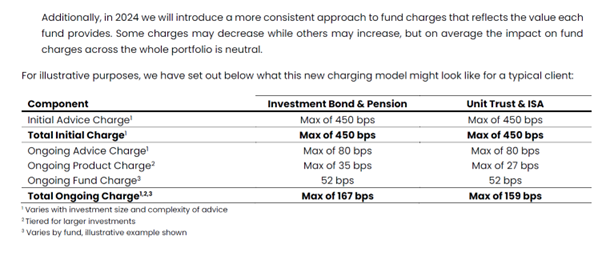

The company will now need to commence a “broad and complex programme” to accommodate these changes. Next year it will introduce changes to its fund charges (see table example below).

Fund charges illustration

Source: SJP

It anticipates it must spend in the region of £140m–£180m before tax to implement all the changes it has announced. About £10m will be spent over the remainder of 2023, £95m in 2024 and the balance in 2025.

Parting gift

With SJP recently revealing its succession plans for departing chief executive Andrew Croft, there had been talk of whether his replacement, Mark FitzPatrick, would be the one to shake things up.

The changes to fees and exit penalties announced by SJP recently are very welcome

Did Croft want to give the firm a parting gift?

On 17 October Croft said: “The changes announced today are about positioning our business for continued success by putting in place a future charging structure that reflects the evolution of consumer engagement with retail financial services, and is aligned to the long-term value that we deliver to clients through the partnership.

“We have always been confident that SJP offers its clients real value that helps individuals and families achieve financial wellbeing. However, it is increasingly evident that consumers are seeking simple comparability, and this has been reflected in regulatory trends too, as highlighted with the assessment of value and the Consumer Duty regimes. The review of our charging model reflects these developments.”

We should start seeing good things happen with SJP fees from next year

He added: “I am confident that SJP’s ability to both deliver and demonstrate value in the future, with this sustainable model of charging for our end-to-end services, is good for clients and represents an exciting opportunity for SJP.”

SJP says it has £158.6bn of funds under management and more than 900,000 clients. It says throughout its history it has evolved to meet changing client expectations and developments in the industry and regulatory landscape.

Changes welcomed

The changes have been welcomed by the founder and managing director of Oakmere Wealth Management — a partner practice of SJP.

Carla Brown tells MM: “My thoughts are that change is welcome. It’s about us demonstrating value to our clients and being much more transparent, which I think is a good move.

We [FCA] recognise that some firms have needed to make significant changes to their business model to improve customer outcomes

“I think it’s going to be in the best interest of both clients and partners because it’s going to make it much easier for us to explain to our clients; it’s going to remove a lot of the negative interest we have attracted recently.

“If this has been brought about by the Consumer Duty then I think the Consumer Duty is doing exactly what it’s designed to do, which is a good thing.”

Talking about the removal of the EWCs and the discrepancy this may cause between existing and new clients, Brown adds: “Clients who have EWCs currently will not have paid any initial advice fees. It would be unfair for them to be removed as new clients going in will be paying initial advice fees.

“The advice has to be paid for somewhere so it would be unfair to new clients if you took it off the old clients because then it means the old clients haven’t paid for advice. These things often get misinterpreted.”

She continues: “Do I wish the pace of change was quicker? Yes, of course I do. But I understand the system issues that are going to take time to be addressed. Some of the charges will start to come into effect from 2024. It’s just the whole transition will be in 2025. We should start seeing good things happen from next year.”

Our continued focus on value and outcomes for clients is consistent with the expectations of the Consumer Duty

Brown explains how it all happened quickly and advisers were informed about the changes when the markets were told.

“We had no prior warning. You do hear things on the grapevine, but we were informed at the same time as the markets because obviously it is market-sensitive information.”

She says communication came out in the days following the announcement and support has been provided to advisers, with webinars and other materials to help conversations with clients. Communication has also been sent to clients directly so they are aware of what’s happening.

She acknowledges change can be scary for people but also suggests there is a place for EWCs.

“Over a longer-term investment, clients would have been better off with an EWC. If they are going to keep the money in for over six years, ultimately the client would have been better off.

Like it or not, SJP is the lens through which many people view the financial planning/wealth management profession

“But I appreciate it can muddy the waters. It’s not especially transparent. I think this is a much cleaner fee structure that will be more transparent for clients. They will know exactly where they are and there is less chance for misunderstandings.”

Brown hopes to see the Consumer Duty prompt other companies to act too. She explains the unbundling of SJP’s charges is welcome because it’s aligned with competitors and will allow the firm to be seen on a like-for-like basis.

“Traditionally it has been seen as quite opaque,” she explains.

“Actually, what’s important to clients is trust — it’s about the relationship and we’ve got so many happy clients it just demonstrates that we are doing a really good job.”

She argues the negativity surrounding SJP can be damaging to the advice profession as a whole — along with arguments between IFAs and restricted advisers.

“It damages public trust because we should be seen as a professional service that looks at itself in a professional manner. If we’re all bickering and fighting and trying to score points, it doesn’t come across that way.

The idea that the various vagaries of charging structures are discussed and understood by the wider public doesn’t register

“Hopefully, the fact SJP is making changes will alleviate some of that and remove some of the negativity across the board.”

Brown also highlights the positive movement SJP is trying to bring to the wider advice profession with its academy, which, along with others, brings greater diversity.

Could the move on fees be what the company needs to shift the conversation away from it, or at least help it to be seen in a more positive light?

I’m not sure we can handle any more big announcements that clash with an MM event.

This article featured in the November 2023 edition of MM.

If you would like to subscribe to the monthly magazine, please click here.

Still charging a whopping 4.5% initial fee. Our max is 1.5% initial.

The table above shows a Maximum Initial Advice Charge of 0.45% and the same Maximum Total Initial Charge. But the latter can’t be right because, were the Maximum Initial Advice Charge taken, there’d be no margin whatsoever left for SJP on either the fund or the product.

Could MM clarify?

Julian – 450bps equates to 4.5% and not 0.45%.

Yes, you’re quite right. But my question remains.

The 4.5% initial is the maximum that can be taken and there will be a sliding scale, based on the size of the investment and the complexity of the advice.

There is an ongoing product charge of 0.35% and a fund charge of 0.52% which will vary

depending upon the fund chosen. Based on that there is scope for SJP to get their margin.

Yes but, according to the table which shows a Total Initial Charge of 4.5%, if the selling agent elects to take 4.5% for himself, that leaves nothing for SJP.

My understanding of the table is that it is SJP and not the partner who decides what they can take as an initial charge. They will probably have a sliding scale based on the size of the investment and the complexity of the advice given by the partner.

For larger investments or complex cases, SJP will take no initial charge but will gain their margin based on the ongoing 0.35% product charge.

The bottom line is that SJP’s margin will be reduced. Hence the large fall in their share price.

As Katey says, they are in no hurry. 2025 is far enough away for them to dream up alternative plans to screw their clients.

That’s perilously close to libel Harry.

If SJP introduces this new charging structure in 2025, they will end up with dual pricing for the same product. Anyone buying a product now will have another four years with the exist fee when the new charging structure is introduced. Whilst new customers buying in 2025 will have no exist fee. SJP will have to do something to address that situation i.e. make the charges the same for all customers.

I have to be honest .. I have never had an issue with SJP

But in response to this article, they are a business and what they charge like anyone else, is between them and their clients, and if they charge high this is nothing but good news for those like us ..

You see it only serves us, as the consumer will seek out better elsewhere …IE us who will offer a better service for a more cost effective offering

My view is leave them alone ….they pose no threat to me or my business.