It’s often said that economics matters more than politics where financial markets are concerned. Recent events challenge this view.

Ten-year gilt yields have risen by the best part of a per cent since mid-September, after a bumper UK Budget and victory for Donald Trump caused investors to increase their estimates for global bond issuance.

Meanwhile, US stocks and the dollar reacted very positively to the outcome of the US election. We expect stocks to continue outperforming bonds, with economics coming once more to the fore.

Government bond yields are back to levels last seen in the decade before the 2007-09 global financial crisis. The latest rise is all the more surprising as yields usually drop when central banks cut interest rates.

It’s hard to know whether to take everything Trump says literally. If you do, he committed to net spending increases of $4-5trn while threatening tariffs and mass deportations

In the last eight easing cycles by the Federal Reserve, Treasury yields have always dropped, falling by an average of 2%. This time, yields have done nothing but rise since the first Fed rate cut in September.

Some of this move reflects unrealistic expectations about Fed rate cuts that were priced in over the summer when some investors thought the US economy was on the verge of recession. Politics is also certainly a big part of the story, both here and in America.

In its first Budget, the Labour government introduced tax increases projected to raise up to £40bn a year by the end of the current parliament to address a revenue shortfall caused by Brexit and the pandemic.

However, spending plans increased even more, suggesting a significant rise in gilt issuance. Labour is banking on stronger growth to bring the finances back into line over the medium term, but this may be hard to achieve without a significantly closer trading relationship with Europe – and harder still if America slaps tariffs on British exports.

Labour is banking on stronger growth to bring the finances back into line over the medium term, but this may be hard to achieve without a significantly closer trading relationship with Europe

Issuance is also in focus across the Atlantic, where neither party in the presidential election was making any attempt to rein in spending despite a budget deficit in excess of 6% of GDP. On one estimate, Harris committed to spend an additional $2trn over her term while raising taxes by $1trn – though these tax rises were thought unlikely to pass a Republican senate.

It’s hard to know whether to take everything Trump says literally. If you do, he committed to net spending increases of $4-5trn while threatening tariffs and mass deportations that could undermine US and global growth.

Bond markets can be very patient, but there are limits. Of many learnings from the UK mini-budget, one is not to throw out the institutional framework while also throwing fiscal sustainability to the wind.

Could the bond market vigilantes turn their attention to the US next spring when a mountain of five-year paper issued during the great Covid lockdown needs to be refinanced? Perhaps, and especially if the independence of the Fed is called into question.

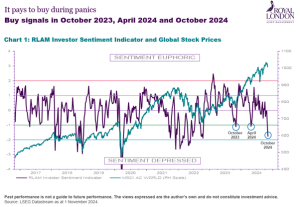

Stock markets have reacted much more positively to the US election result. This is, in part, because investor sentiment became very depressed ahead of the vote with our proprietary indicator hitting its most oversold level since the 2022 bear market. Stocks like the lower tax, lighter regulation implied by a Trump presidency. For now, they are not factoring in the possible impact of Trump’s other policies.

The economic cycle may buy Trump some further benefit of the doubt in the markets. Our Investment Clock model is signalling disinflationary recovery.

Stronger profits and lower interest rates should help stocks to continue outperforming bonds. And with inflation back under control, unexpected economic weakness would be met with further interest-rate cuts.

Trump’s key policies may well be a drag on growth over the longer term, but we don’t know when they will take effect and what form they will take, and we don’t know how strong the tailwind will be from a global recovery. As macro investors, we’re watching developments closely. Economics is coming once more to the fore.

Trevor Greetham is head of multi-asset at Royal London Asset Management

Has the $USD gone up??

XE (wholesale) put it at 1.25 to £GBP… a month ago it was 1.30… err… a fall around 4%…

Option and swap volatility have increased, indicating more unceartainty in the relevant markets…

Unlike bonds, traditionally, AAA rated stocks have yielded more than lesser rated ones – but you have to accept a narrow portfolio spread, E.g. US AAA is only Microsoft and J&J currently…

With the Euro looking shaky for longer… and the Swiss not wanting to support it as they have relentlessly since inception, and Euro zone co. earnings errm… poor (polite version), looks like Roulette (French only remember) offers better and better value especially once the tax status is included, + cheap drinks too!